Top US Exchange Says This Could Be the Last Chance to Grab XRP at Current Low Prices: Heres Why

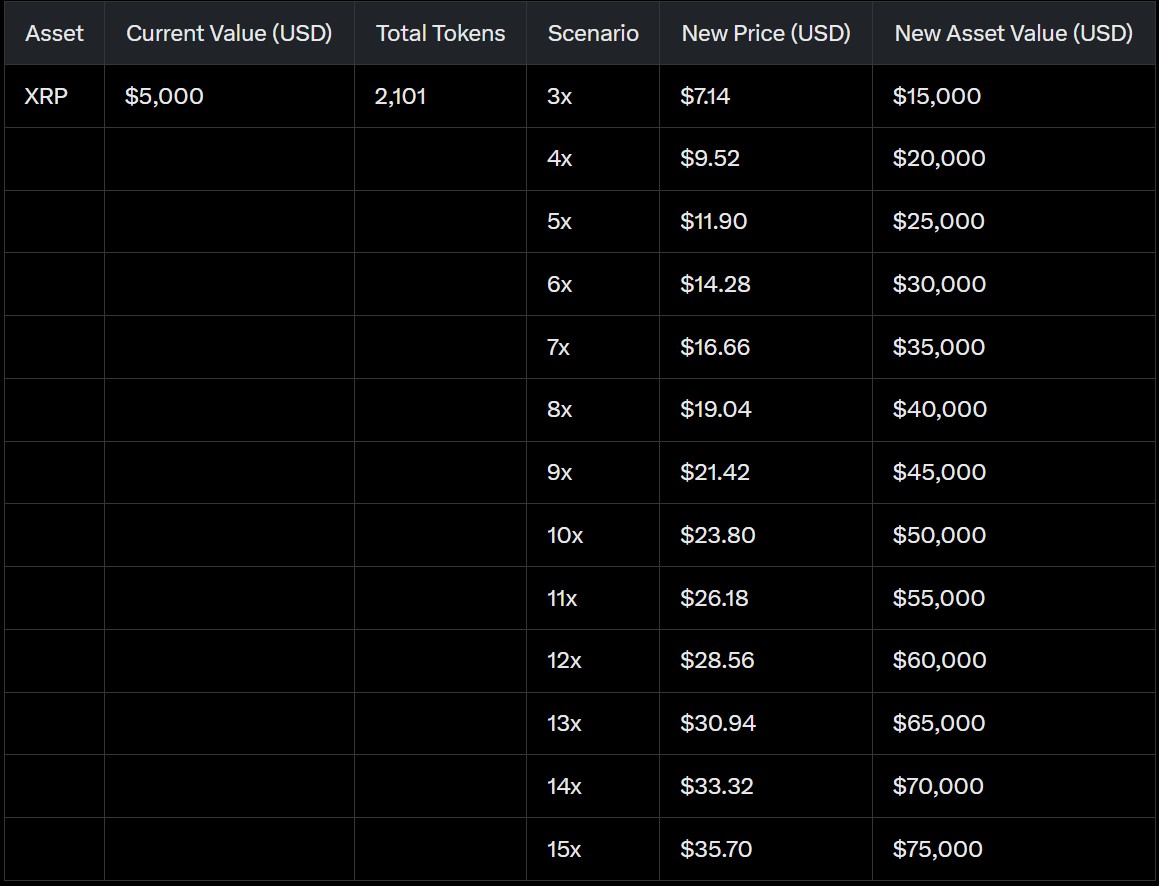

While XRP holds steady around the $2 mark after Bitcoin has made history, prominent market watchers believe June 2025 could change everything for XRP.According to Martin Hiesboeck, Head of Research at U.S.-based Uphold exchange, the stars may be aligning for XRP's next major breakout or its last calm before the storm.Notably, the optimism relies on three major events scheduled for June. Hiesboeck suggested that the current price range could be the final entry point before another powerful movement. The Uphold exchange itself also shared this sentiment in a follow-up commentary to Hiesboeck's analysis.Spot XRP ETF Decision as a Game-ChangerOne of the most closely watched dates is June 17, when the U.S. SEC could issue a ruling on Franklin Templetons spot XRP ETF application. After missing the original May decision window, anticipation has only grown. At least ten XRP ETF applications exist with a final decision timeline in October.Hiesboeck noted that a green light from the SEC could catapult XRP into the mainstream financial ecosystem, much like Bitcoin surged after its ETF approvals in January 2024. While Ethereums ETF launch had less impact in mid-2024, proponents argue that XRP's unique utility in cross-border payments and increasing institutional attention could fuel a more dramatic price reaction.Feds June Meeting Could Trigger Altcoin SurgeRunning almost in parallel with the ETF decision is the Federal Open Market Committee (FOMC) meeting on June 1718. Here, traders are watching for potential interest rate cuts. Risk assets like crypto could benefit if the Fed adopts a more dovish policy in response to growing economic stress or global trade tension. Altcoins like XRP often outperform during liquidity-driven rallies, as investors rotate away from large-cap assets like Bitcoin in search of higher upside. Specifically, a rate cut could inject fresh momentum into the altcoin space.XRPL APEX Conference May Reveal Ripples Next Big MoveThe third piece of the puzzle is the XRPL APEX, an annual XRP developer summit scheduled for June 1012 in Singapore. The event will feature Ripple executives and leading builders discussing the future of the XRP Ledger (XRPL).The agenda hints at major updates, including integrations with artificial intelligence, cross-chain interoperability, DeFi, and real-world asset tokenization. According to Hiesboeck, if Ripple delivers any major product launches or partnerships, investor sentiment around XRP could soar, fueling a potential rally.The Window May Be ClosingXRP has already demonstrated its ability to move fast, jumping from $0.50 on U.S. Election Day 2024 to a high of $3.39 within just two months. Since then, it has consolidated between $2 and $2.50. During this time, many traders have been on the sidelines waiting for a clear signal. Meanwhile, Uphold summed it up, saying, "June could be make-or-break for XRP." As May draws to a close, Uphold suggests market participants may be seeing the final opportunity to acquire XRP at under $3. These three critical catalysts converging in a short span make market watchers believe the incoming month could mark XRP's new breakout point as seen in November 2024.https://twitter.com/UpholdInc/status/1925319693965172883

About Info :

About Info :