Nov 03, 2022 12:05

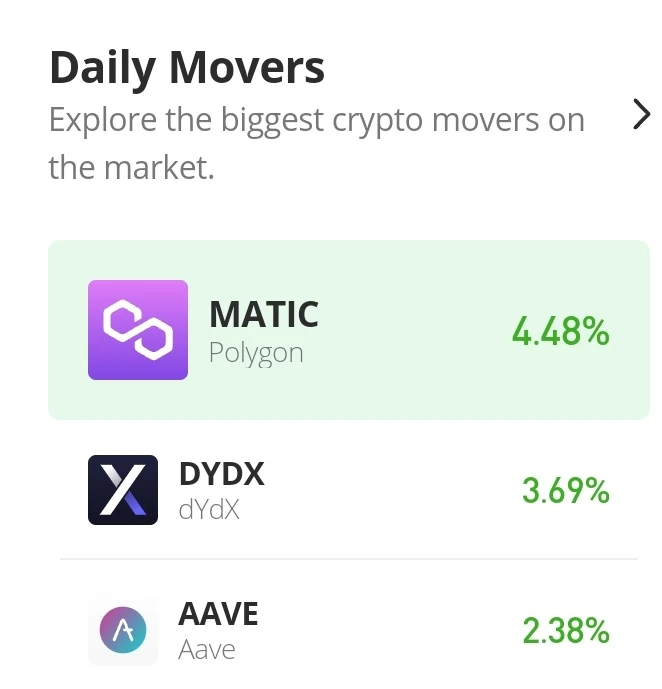

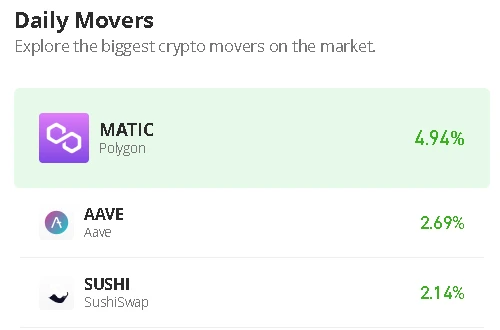

Legacy financial institutions are embracing crypto and decentralized finance (DeFi), and the Ethereum-based protocol Aave is proof. Today, the team behind the protocol announced that banking giant JP Morgan Chase completed its first DeFi transaction. 5/5 @jpmorgan transacting on a public blockchain using Aave smart contracts is a huge milestone for DeFi, and represents a massive step towards bringing traditional financial assets into DeFi, to fully realize the opportunities afforded by smart contract based dApps. — Aave (@AaveAave) November 2, 2022 This represents a major milestone for the sector that continues to see high demand and adoption despite the downside trend in the crypto market. Two years ago, the total value for the DeFi sector, as measured by the total value locked (TVL), was less than $5 billion. Related Reading: Bitcoin Bullish Signal: Whales With 1k-10k BTC Have Been Accumulating In a short period, this metric will increase by over 20-fold, reaching an all-time high of around $170 billion by 2021, according to data from DeFi Llama. Today’s milestone marks a new era for the nascent sector and digital assets. Aave Supports Major JP Morgan Transaction According to the official announcement, JP Morgan leveraged a “modified” version of the Aave protocol. Due to its higher scalability, the project used Ethereum’s second-layer solution, Polygon. The team behind the protocol said: The Aave protocol was utilized by involving the supply and borrowing of tokenized foreign exchange transactions, using SGD tokenized deposits (1st issuance of tokenized deposits by a bank!) issued by J.P. Morgan and JPY tokenized assets issued by SBI Digital Asset Holdings. The transactions are part of the Monetary Authority of Singapore (MAS) led “Project Guardian.” The initiative explores ways to bridge legacy financial institutions with decentralized finances “across a broader range of use cases.” WORLD! J.P. Morgan has executed its 1st *LIVE* trade on public blockchain using DeFi, Tokenized Deposits & Verifiable Credentials, part of @MAS_sg Project Guardian ??????https://t.co/XI212SG4zg Many world 1sts here, & since this is public ? here’s a transparent??on what we did: — Ty Lobban (@TyLobban) November 2, 2022 In addition to JP Morgan, other major banking institutions are participating in the initiative, including DBS Bank, SBI Digital Asset Holding, and the Oliver Wyman Forum. These transactions are the first in a series of pilot tests to explore the potential for DeFi and digital assets to improve the interoperability and efficiency of legacy financial markets. Related Reading: Ripple (XRP) Sits On Key Support; Here Is What Could Happen If $0.45 Fails Project Guardian was announced in May 2022, its objective is to “identify” the key areas where traditional financial institutions and DeFi protocols can collaborate. So far, the initiative has identified pilot programs to “unlock economic value,” the study of regulatory and risk management, developing technology standards, and others as areas of interest. Chief FinTech Officer at MAS, Sopnendu Mohanty, said: The live pilots led by industry participants demonstrate that with the appropriate guardrails in place, digital assets and decentralised finance have the potential to transform capital markets. This is a big step towards enabling more efficient and integrated global financial networks. Project Guardian has deepened MAS’ understanding of the digital asset ecosystem (…).