Oct 01, 2024 12:05

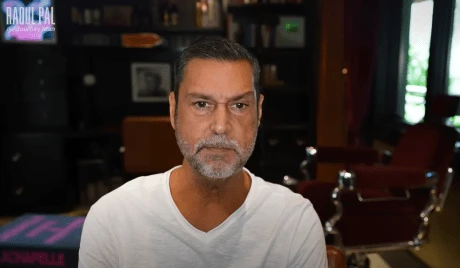

Raoul Pal, the founder of Real Vision and a recognized figure in the crypto community, has issued a stark warning about the rapidly approaching transformations in the global economy, driven by unprecedented technological advancements. In his latest video, Pal, who has long advocated for an understanding of what he calls the “exponential age,” claims that the coming years will bring about the largest changes humanity has ever experienced, due to the rapid development of artificial intelligence (AI) and robotics. According to Pal, we are nearing what he terms the “economic singularity,” a point beyond which current economic, market, and business frameworks will no longer be applicable. By about 2030, things are going to become not understandable by using the existing frameworks of economics, financial analysis, markets, and that kind of stuff, Pal explains. Pal He asserts that AI and robotics are advancing at a pace that will soon outstrip human capacity to adapt under current economic systems. Falling birth rates and aging populations across developed nations are leading to a decline in the traditional economic drivers of GDP growth. Moreover, Pal notes that productivity has not kept up with technological capability, and most new debt is simply servicing old debts, not creating new economic value. Related Reading: Grayscales Bullish Forecast: The Top 20 Crypto To Watch In Q4 The most significant aspect of Pal’s warning concerns the role of AI in the economy. He believes that AI will reach and surpass human levels of intelligence across all areas of knowledge, fundamentally altering the landscape of labor and productivity. AI is basically infinite human knowledge now […] As these models scale, the breakthroughs come through, and the average IQ of AI goes from 100 to 400, and then on to a million times the intelligence of a human, Pal states. This immense growth in AI capabilities is expected to lead to what Pal describes as infinite productivity and a near-zero marginal cost of electricity, primarily due to advances in renewable energy technologies. He argues that these factors will lead to massive deflationary pressures as goods and services become increasingly inexpensive to produce. The Key Role Of Crypto Pal is particularly bullish on the transformative power of blockchain technology and cryptocurrencies in this context. He describes a future economic model where “AI agents” perform tasks and transact autonomously using cryptocurrencies, given their ability to operate independently of traditional banking systems. Related Reading: VP Kamala Harriss First Speech On Crypto Sparks 7% Rise In This Memecoin Obviously, we’ll probably need crypto payments to pay you. […] I think we’ll use cryptocurrency to do that because last thing I checked, AI can’t get a bank account – it’s never going to transfer money over SWIFT, never going to happen, Pal remarks. Pal urges viewers to recognize the urgency of investing in cryptocurrencies. He advises that the window for capitalizing on these technologies is closing fast, with only about six years left to make substantial gains before traditional economic and market structures transform irreversibly. “We’re going to have to go through this together and we have to be smart and try and figure it out as we go but I do know that this idea of 6 years to make as much money as possible is really important and I do think that the real answer to this, as far as I can see, is cryptocurrency because it is the best performing asset in the world and of all time. So I think that’s the one thing we can lean in, it has a huge future, Pal says. At press time, Bitcoin traded at $63,588. Featured image from YouTube, chart from TradingView.com