Sep 14, 2022 09:05

So it's confirmed - A group of developers are working behind the scenes with Ethereum miners to hard fork the Ethereum blockchain after next week’s merge. This means there will still be a version of the network running on the current Proof-of-Work (PoW) consensus mechanism while the 'official' Ethereum 2.0 blockchain transitions to Proof-of-Stake (PoS).

With that comes a separate and completely independent Ethereum token, currently being called 'ETHPoW' but the coin's official name is still undecided.

All Ethereum holders will receive ETHPoW automatically, an amount equal to the regular Ethereum you hold...

Major exchanges Binance, MEXC Global, Gate.io, and FTX have already agreed to list and support trading of the forked token. Poloniex is even a step ahead of the rest, and has already listed a placeholder token that will be swapped for the real thing once it's live.

Coinbase and Kraken both say they're open to supporting it, but haven't yet made a full commitment, likely waiting to see if the coin will have any demand or value.

ETHPoW will join the two existing Ethereum tokens - the 'official' Ethereum (ETH) and Etherum Classic (ETC)...

The upcoming 2.0 fork won't be Ethereum's first, the previous fork ended with two coins and two versions of Ethereum - Ethereum and Ethereum Classic.

To summarize what happened then - in 2016, hackers exploited a security hole in a project called 'The DAO' allowing them to steal about $50 million worth of ETH. A solution was proposed to re-launch Ethereum with the history of the hacked coins completely erased, like it never happened.

How they went about doing this caused a lot of controversy, it was all decided when the proposal was put to a short notice on-chain vote. Only 5.5% of potential voters participated, but since the majority of them voted 'yes', the fork happened.

Those in the Ethereum community who disagreed with the decision simply ignored the change and continued to participate on the original Ethereum network, which became known as Ethereum Classic.

While Ethereum Classic is considered one of the most successful forked tokens, ETHPoW's Success is far from a 'sure thing'..

When Ethereum Classic started, its support, in large part, came from the controversy that created it.

Some in the community strongly disagreed with the idea of editing the 'true' history of the Ethereum blockchain, and Ethereum Classic kept that intact. Others disagreed with how the decision to fork the coin was made, saying they would support any decision that had over 50% of potential voters backing it, but the fork went ahead without even coming close.

Ethereum Classic succeeded, and is still active today, because the people behind it truly believed in it.

But when it comes to Ethereum 2.0 - it isn't controversial, it doesn't violate the beliefs of a large portion of the community.

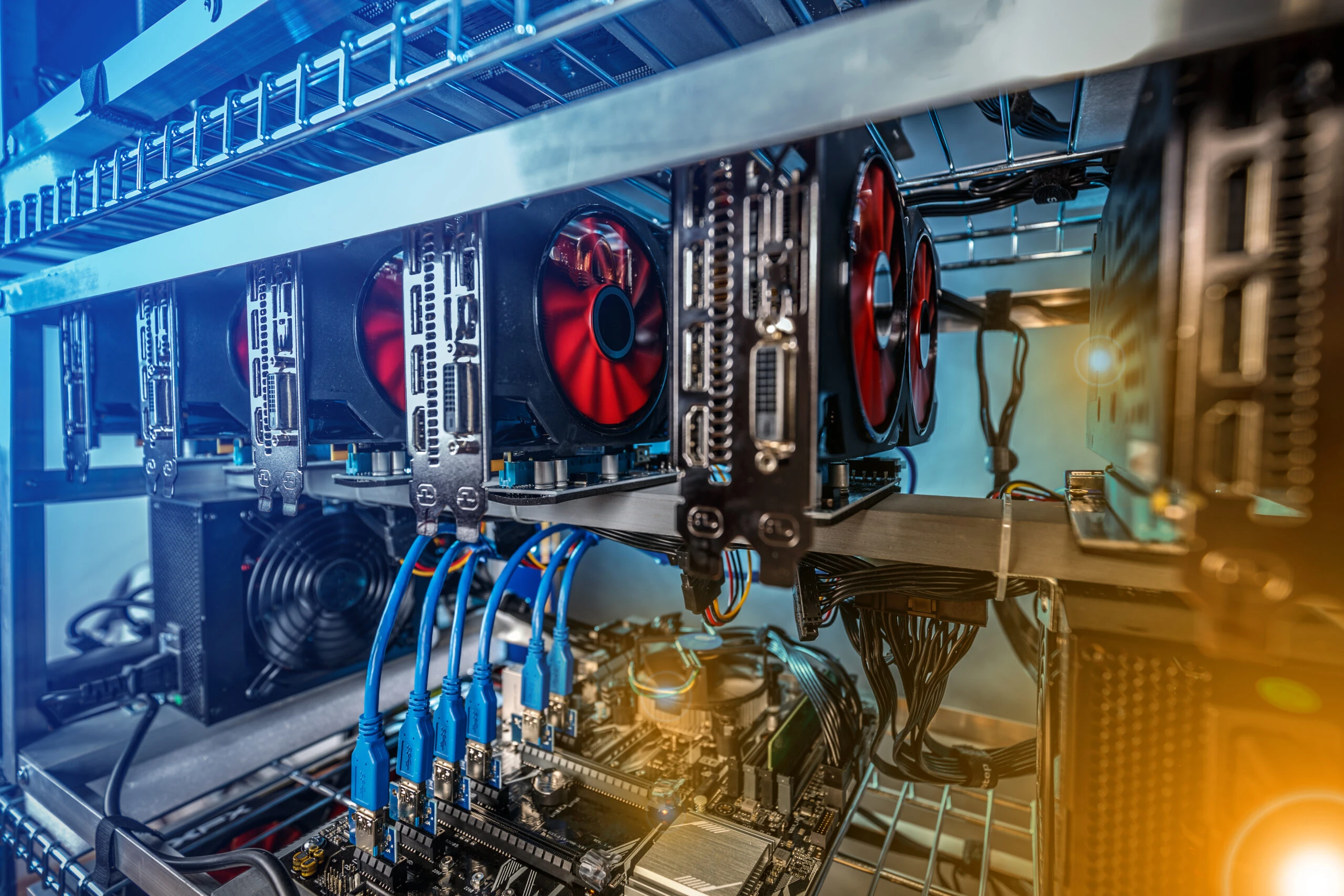

The only segment of the community united against 2.0 are miners, because once Ethereum has fully moved to the 2.0 Proof-of-Stake consensus mechanism, miners are no longer needed to verify transactions. Their motivation to continue supporting the old version of Ethereum is entirely profit-based. These are the same miners who loved it when we couldn't send $1 on the Ethereum blockchain without paying a $75 fee.

That just doesn't sound like the beginning of a token that will have long term success.

Take a look at the two most successful forks in crypto's history - Ethereum Classic and Bitcoin Cash. All others have faded away, while these two remain in the top 50 because they're backed by a community of supporters who believe their existence is important. You can find their supporters making passionate arguments on where they think the 'official' version of the coin went wrong, and why these alternatives make things right.

This is why dumping ETHPoW as soon as possible may end up being the smartest move...

There already is an Ethereum alternative for anyone who doesn't want to support the 'official' version - Ethereum Classic. It's already accomplished the hardest part - establishing itself among the small list of coins traders can trust to retain value, and can be found on every major exchange.

There just isn't a good reason for another alternative - maybe the Ethereum brand is big enough where it finds support even if it isn't necessary. But even forks of Bitcoin that every Bitcoin holder received for free met a quick death, because people didn't believe they needed to survive.

How to make sure you'll be able to access your ETHPoW as soon as it becomes available...Typically the day forked coins go live, is the day they have the highest value, so if you're aiming to be among the first to trade yours, you'll want to transfer any Ethereum you own off of any exchanges and on to a wallet like Metamask, where you hold the private keys.

Once it launches, you'll be credited an equal 1:1 amount of ETHPoW for any Ethereum you own, and will be able to access it in the same wallet that holds your regular Ethereum. You'll need to switch networks (blockchains) and we'll make sure to post the settings you'll need as soon as that becomes known.

If your Ethereum is on an exchange they will need to take several additional steps to distribute each users portion, this is because they store multiple users coins together. In the past, some exchange users waited weeks or even months longer than those holding crypto in their own private wallets.

Do you think ETHPoW has long term potential, or think odds are against it? Tweet us your thoughts @TheCryptoPress

-----------

Author: Ross Davis

Silicon Valley Newsroom

GCP | Breaking Crypto News

Subscribe to GCP in a reader