Solana Network Activity Grows As 11M Wallets Now Hold 0.1 SOL Or More Analyst

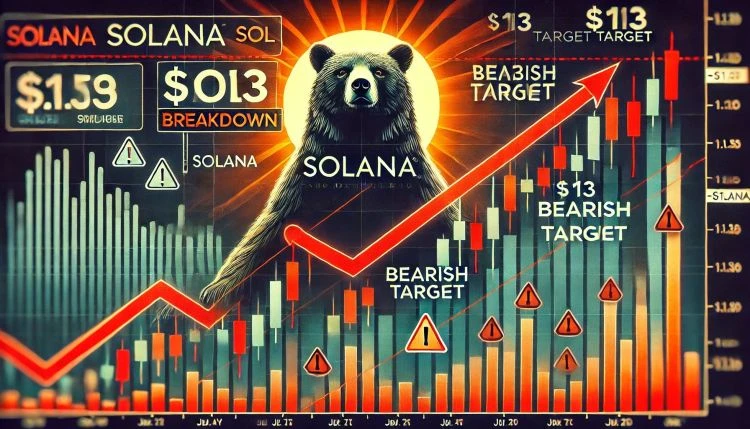

Solana has rallied more than 22% since last Thursday, riding the wave of renewed bullish momentum across the broader crypto market. As Bitcoin pushes toward all-time highs and Ethereum breaks key resistance levels, Solana has followed suit with impressive strength. The price surged to a local high of $181 before encountering resistance, where it now consolidates just below that mark, searching for support to fuel the next leg higher. Related Reading: Ethereum Hits Major Level After Biggest Weekly Candle In Years What Comes Next? While price action cools at a pivotal level, on-chain data shows significant growth in Solanas user base. According to Glassnode, the number of wallets holding 0.1 SOL or more has surged to 11.04 million in the past two weeks. This rapid increase in smallholder wallets points to a rising wave of adoption and network participation, particularly as interest in altcoins intensifies. Solanas consolidation just under $181 may act as a healthy pause before a continuation if bullish momentum persists. With the market heating up and retail interest returning, the current price structure could offer the foundation for a strong breakout in the coming sessions. The combination of price performance and rising user engagement suggests Solana may be positioning for a larger role in the next phase of the bull cycle. Solana Holds Key Support As Wallet Growth Signals Optimism Solana is now facing a crucial test as it consolidates just below the $181 resistance zone. After a sharp 22% rally over the past week, bulls must defend current levels to validate the uptrend and sustain momentum. Holding above the $170$175 support range would confirm strength and could pave the way for a renewed push toward the $200 level. However, the path forward isnt without risk. The broader macroeconomic environment remains fragile, with persistent fears of a global slowdown and continued uncertainty around inflation and interest rate policy. Despite these headwinds, the crypto market is staging a powerful recovery, and Solana is among the top performers. This rally may be more than just a short-term bounceit could mark the early stages of a larger bullish phase with significant upside potential. Investor sentiment is improving, and so is user engagement across key ecosystems. Top analyst Ali Martinez shared compelling on-chain data that reinforces this perspective. According to Glassnode, the number of wallets holding 0.1 SOL or more has surged to 11.04 million over the last two weeks. This rapid growth in smaller holders suggests growing retail interest and a widening user basecritical indicators for long-term strength. If bulls can maintain control at current levels and macro conditions dont worsen, Solana could be poised for a major move. The combination of technical momentum and on-chain engagement provides a strong foundation for the next leg higher. All eyes are now on whether the $181 resistance breaksor if Solana needs more time to build strength before the next phase of the rally begins. Related Reading: Ethereum Recovery Gains Strength: Massive Comeback Above Key Support Solana Faces Resistance As Price Pulls Back To Retest Support Solana (SOL) is consolidating just below the $181 level after a strong 22% rally from last week. As shown in the chart, price action surged above both the 200-day EMA ($161.88) and 200-day SMA ($181.11), signaling renewed bullish momentum. However, the current pullback from $180 to around $173.48 shows that the $181 level is acting as a key resistance, which has previously served as a rejection zone multiple times in the past. Volume remains healthy, and the recent move shows strong market participation, but bulls now need to hold the $170$172 range to maintain control. A successful retest of this area as support could set the stage for a breakout above $181. Failing to hold above this zone, however, could trigger a correction back to the $160$165 region, near the 200 EMA. Related Reading: HYPE Bulls Regain Control After Sharp Recovery Approaching Yearly Highs? Technically, SOL is attempting to break a multi-month downtrend and is forming a higher high structure for the first time since late December. The convergence of the moving averages suggests a pivotal moment. If buyers step in with conviction, a move toward $200 becomes likely. Until then, traders will closely watch the $181 level for a decisive breakout or rejection. Featured image from Dall-E, chart from TradingView