Solana Set For A Major 53% Price Move, Analyst Reveals Why

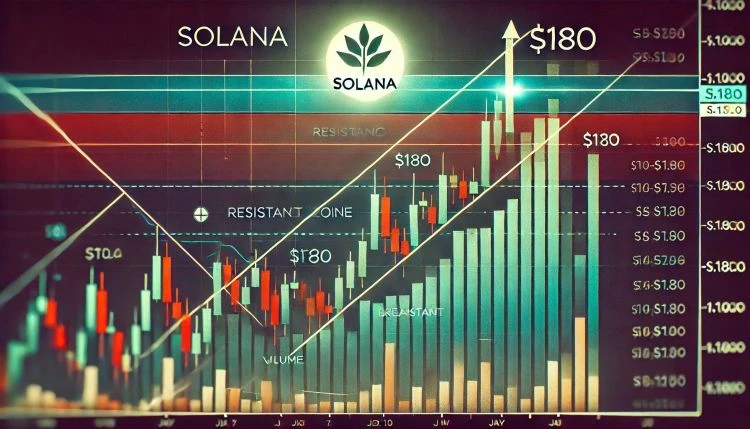

An analyst has explained how Solana could be setting up for a major 53% move based on a Symmetrical Triangle pattern forming in its price chart. Solana Has Been Travelling Inside A Symmetrical Triangle Recently In a new post on X, analyst Ali Martinez discussed a pattern that has recently taken shape in Solana’s daily price chart. The technical analysis (TA) pattern in question is a “Symmetrical Triangle,” which, as its name implies, looks like a triangle. The triangular shape comprises two converging trendlines, with the upper line joining successive lower highs and the lower one connecting higher lows. A key feature of this pattern is that these lines approach each other at roughly the same slope (hence the “symmetrical” in the title). Related Reading: Why Is Bitcoin Stagnant Despite ETF Inflows? Report Answers Like other TA patterns, when the asset price consolidates in the region bounded by these trendlines, resistance will probably be at the upper level and support at the lower one. A break out of either of these lines can suggest a continuation of the trend in that direction. Naturally, a break above the triangle could be a bullish signal, while a decline under the pattern could lead to a bearish outcome. Similar to the Symmetrical Triangle, there are other triangle patterns in TA. A couple of popular ones include the Ascending and Descending Triangles. These patterns differ from the Symmetrical Triangle in that one of their trendlines is parallel to the time axis. Now, here is the chart shared by the analyst that shows the Symmetrical Triangle that the 1-day price of Solana has been trading inside over the last few months: As the above graph shows, Solana has been closing in at the tip of this Symmetrical Triangle pattern recently. As consolidation becomes tighter, a break out of the pattern naturally becomes more probable. As mentioned earlier, which of the two lines the breakout happens from sets the direction the potential price move would go. “Keep an eye on the $143 support and $178 resistance levels to gauge the direction of the SOL trend,” notes Ali. Related Reading: Is Bitcoin Overheated Right Now? This Metric Suggests No From the chart, it’s apparent that Solana is currently floating near the bottom line, so a retest could be coming up soon. If bullish momentum has to return for the coin, this retest must be successful. Moves resulting from a breakout of a Symmetrical Triangle may be the same length as the triangle’s height. In the case of this Solana Symmetrical Triangle, the height represents a price swing of 53%, so Ali believes that a breakout would also set the coin up for a move of a similar scale. SOL Price Solana hasn’t had the best times during the last few weeks, as its price is now down to $149. It remains to be seen whether a potential upcoming retest of the Symmetrical Triangle support would change the coin’s fate. Featured image from Shutterstock.com, charts from TradingView.com