Kamala Harris Allegedly Working On Crypto Policies With Industry Advocates Scaramucci

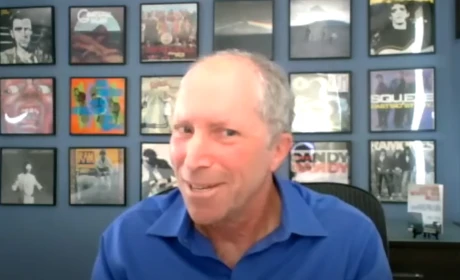

At the TOKEN2049 conference, SkyBridge Capital founder Anthony Scaramucci revealed that US Vice President and Democratic nominee Kamala Harris is working alongside industry advocates on her crypto policies before the November elections. Related Reading: Solana (SOL) Flies 12% To Reclaim $140, Is $160 Next? Kamala Harris Distancing From Warren And Gensler On Thursday, Anthony Scaramucci claimed to be working alongside Kamala Harris to develop her campaigns crypto policies. SkyBridge Capitals founder announced at one of the largest crypto events worldwide that the Democratic nominee has been hearing out industry proponents. Scaramucci and other undisclosed crypto and Bitcoin advocates have been allegedly pushing the US VP to back industry-friendly policies. These talks have been seemingly making progress and going in the right direction, he stated at the event. Moreover, the industry advocates working alongside Harris want to prevent crypto policies from becoming a partisan issue, aiming for crypto in the U.S. to have a bipartisan standard unstrained from political and tribal conflicts. Scaramucci also stated that they are working to distance the Democratic Party from figures like Senator Elizabeth Warren and Gary Gensler, who have had a big role in the USs crackdown on the industry. The Democratic candidates stance on the sector has been heavily speculated since she was nominated. Nonetheless, Harris, whose stance remains undisclosed, has been endorsed by several industry figures, including Ripples co-founder Chris Larsen and Bitcoin bull Mark Cuban. Who Is The Crypto Industrys ‘Favorite’ Candidate? At the TOKEN2049 panel, Scaramucci also commented on his feelings about former US president Donald Trump. He applauded the Republican candidate for understanding the industrys importance, claiming that he has changed the landscape ahead of the elections: Whatever my feelings are about President Trump, I applaud him for understanding how important this industry is for the United States, and I think ironically, hes pulling the Democrats along into a centrist position on regulation. Trumps stance has pushed the Biden-Harris administration toward a more industry-friendly approach in the past few months. In a recent interview with CNBC, Cardanos founder, Charles Hoskinson, also suggested that Trump might be the favorite option from a crypto perspective. To him, the Republican candidate is the clear industry favorite as he has openly embraced the sector, even launching a DeFi project. The community has also launched several Trump-inspired memecoins throughout his campaign, which lead the PolitiFi token sector. Related Reading: Will Bitcoin Break Through $70k? Short-Term Holders Buy Price Holds The Key Since the presidential debate on September 10, the US VP has challenged the Republican candidate’s winning odds. Prediction markets like Polymarket show that Harriss chances of winning surpass Trumps by 3%, with 51% odds in her favor. Nonetheless, Hoskinson considers that regardless of who wins the election, the world will continue to move toward crypto adoption. The world, with or without America, is embracing cryptocurrencies, he stated. As of this writing, Bitcoin, the largest cryptocurrency by market capitalization, is trading at $63,480, an 8% increase in the past week. Featured Image from Unsplash.com, Chart from TradingView.com