Bitcoin And Nuclear: The World’s Most Feared Technologies Can Actually Save It

Humanity must produce an excess amount of energy in order for forward progress — but with increasing demand, how can we achieve this?

Much has been written about how intermittent renewables like wind and solar negatively affect grid stability and often need government subsidies to produce positive financial returns on investment (ROI). Less well understood, but even more important, is the fact these intermittent renewables reduce our global net energy surplus when compared to the coal, oil, natural gas and nuclear energy sources they replace. In other words, our current technologies generate a higher energy output on their energy inputs versus wind and solar.

The world’s current standard of living is a direct result of power-generation technologies producing a high energy surplus. Research suggests electricity from wind and solar is unable to achieve break-even levels relative to the existing energy surplus economic threshold, suggesting they will diminish our future standard of living.

Understanding why energy surplus matters is key to understanding human progress. It is also the key to understanding how the Bitcoin network’s energy-reliant proof-of-work consensus mechanism can be a tool that expands society’s energy surplus well into the 21st century.

What Is Energy Surplus?

Having an energy surplus is fundamental to survival.

Take a cheetah, for example. A cheetah consumes a tremendous amount of energy pursuing its prey. Many of these chases are unsuccessful. For the few that result in a kill, the energy provided by eating its prey must be greater than all the energy consumed in prior chases (and be enough for the next chase).

However, beyond the maintenance energy required just to live and hunt, the energy surplus must also be large enough to allow a mother cheetah to give birth, nurse her cubs and devote time and energy to raising them. For a cheetah to live normally, its energy surplus must be well above a break-even level.

The same can be said of a fish, an insect, a tree or any organism or system that requires energy, including humans and human economies. The larger the energy surplus within a system, the more diverse, robust and resilient the system is because it can easily meet its basic needs with surplus energy for reproduction, experimentation, innovation and growth.

Energy surplus, or net energy, is measured by energy returned on energy invested (EROEI). EROEI is the ratio of the energy gathered by a system — numerator or the caloric energy of the prey — to the energy expended in the process of gathering that energy — denominator or the energy expended on the hunt. To be accurate, the calculation should use energy units, preferably joules, the international standard for measuring the energy content of heat and work.

Like a financial ROI, an EROEI > 1 shows that a system gathers more energy than it expends to gather that energy, e.g., the cheetah eats more calories than it needs for basic functions. The result is surplus energy that allows a mother cheetah to give birth and raise her cubs. When EROEI = 1 the energy received equals the energy spent (breakeven) and the cheetah barely survives and cannot reproduce. An EROEI < 1 indicates that the system requires more energy than it is able to gather, e.g., the cheetah cannot survive.

In the human world, an EROEI < 1 is also a recipe for death and extinction. An EROEI = 1 is a tenuous balance between life and death with no surplus energy for societal growth and advancement. However, a large and increasing energy surplus produced from high EROEI technologies has allowed human civilization to expand and flourish creatively, technically and culturally.

Energy Is Real Wealth

Simply put, energy is our real wealth and our growth depends on how efficiently we convert primary energy into useful energy that enables us to do useful work. As humans evolved over millennia we developed better and better technology to find and convert increasingly dense sources of primary energy into useful energy.

For example, crude oil contains about 44 MJ/kg (megajoule per kilogram) of heat energy, black coal about 25MJ/kg, dry wood about 16MJ/kg and peats and grasses 6-7MJ/kg. When combusted, their stored chemical energy produces heat. Additional technology converts some of that heat to a more useful secondary energy like electricity. Human technology continued to advance to be able to harness oil’s higher energy density versus the peats and grasses that our distant ancestors used for fuel. From this denser energy came exponential growth in society’s energy surplus that also unleashed massive gains in technological innovation and standards of living.

While we often focus on a technology’s energy efficiency of converting fuel into work (e.g., an internal combustion engine has an operating thermal efficiency of +/- 25%), EROEI analysis takes a more holistic approach. It accounts for the additional energy costs of the materials and processes needed to build the engine along with operating it. This is where EROEI analysis can shed light on the energy surplus of different power plant technologies.

For a power plant, the EROEI equals the energy produced over the life of the plant divided by the energy that was required to build, operate and decommission the plant. After including the energy costs of its components like steel and concrete and the energy costs of its fuel, a fossil fuel power plant needs to produce at least the same amount of energy over its lifespan to break even on an energy basis. Same goes for renewables and nuclear.

However, running an energy break-even power plant would be pointless, since all the energy produced in the plant’s lifetime operation would be offset by an equal amount of energy consumed to build and operate the plant. There would be no energy surplus for all the other things we need (food production, schools and hospitals, etc) and want (museums, travel, sports, scientific research, etc).

Recall that a cheetah requires an energy surplus just to live a normal life. So do humans in the 21st century, but to a much greater degree.

What’s EROEI Got To Do With It?

One of the most comprehensive and rigorous analyses of different power plants’ EROEIs is a pair of papers by Weißbach et al1. The authors applied a uniform bottom-up methodology to calculate the energy costs (in terajoules) adjusted to exergy (the utilized/useful energy) embedded in the materials, labor and fuel supplies required to build, operate and decommission various electricity-generating technologies. This utilized energy investment was divided into the utilized energy returned — the electricity generated over the lifespan of each type of power plant — to calculate individual EROEIs.

The authors also compared the representative plant EROEIs to an economic EROEI, termed the “economical threshold.” This is approximated by the ratio of an economy’s GDP to its unweighted final energy consumption. In practice it is GDP divided by total end energy consumption for the same time period divided by the average cost of that end energy consumption. The resulting quotient captures the economic value of the “energy dividend” that the energy-producing part of an economy pays to the non-energy-producing parts of the economy.

A high and growing economic threshold describes a world with highly efficient energy-gathering processes that produce a large energy dividend allowing an economy to diversify, grow and flourish. A declining economic threshold indicates a system in contraction with less efficient energy-gathering processes that crowd out other non-energy sectors leading to a decline in levels of economic prosperity.

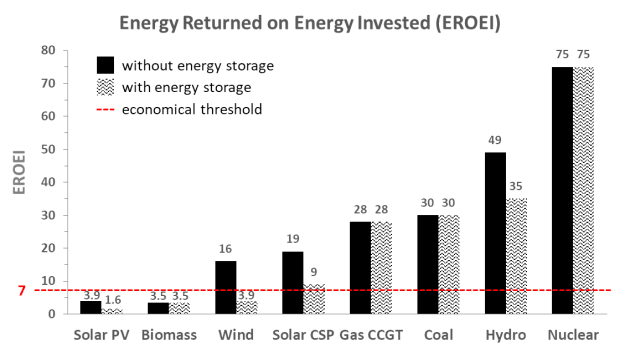

The results of the paper’s analysis are shown in the chart below.

It is clear that wind and solar have EROEIs that are orders of magnitude below established electricity-production technologies. They consistently underperform those of hydro, nuclear and fossil fuel power plants, and when energy storage is included, their EROEIs further deteriorate.

Except for hydro, most renewables can’t achieve the break-even economic threshold. In other words, they can’t stand on their own, energetically speaking. They would fail if they had to deliver the energy for their construction, operation and decommissioning and are dependent on the existing energy surplus from fossil fuels and nuclear. Moreover, inserting them into our present energy mix as replacements for existing fossil fuel and nuclear technologies will dilute our current economic wealth.

There are four main reasons intermittent renewables don’t measure up:

- Wind and solar technologies require large quantities of costly high-energy materials (steel, concrete, copper and PV panels) relative to their lifecycle energy output.

- Wind and solar have shorter life cycles (20-30 years) than plants that run on fossil fuels, hydro or nuclear(50-70), which recover their initial energy costs quickly and have longer operating periods to generate surpluses.

- Wind and solar intermittency results in lower capacity factors (actual energy output over time vs potential energy output) than hydro, nuclear and thermal. This typically results in overbuilding by 2-4x, which requires more materials and higher energy investment costs.

- Intermittent wind and solar require the addition of buffering via batteries to make their electricity useful to the grid. Energy storage is not new energy, just a time shift of electricity use. Batteries are very energy intensive to manufacture and always have an EROEI < 1. As a result, any electricity-producing technology requiring batteries will have a lower combined EROEI than the generation component itself, as Weißbach’s results show.

When we remove high-EROEI technologies and replace them with low-EROEI technologies we decrease the total energy surplus that supports daily life as we know it. More of an economy ends up being dedicated to energy-gathering activities at the expense of other economic sectors. It’s not the direction humanity wants to go after decades of benefiting from high energy surpluses directly attributable to fossil fuels.

Time To Go Nuclear

So what can meet our growing need for electricity with the highest EROEIs? Nuclear.

Nuclear produces tremendous surplus energy as seen by its EROEI of 75. It produces more than twice as much surplus energy as natural gas and coal.

Nuclear benefits from three important factors: it uses an energy-dense fuel (3.5% enriched uranium has 3,900GJ/kg) relative to the fuel’s energy costs of production; it operates at the highest capacity factors of all available electricity-producing technologies; and it has the longest useful life cycles. Nuclear plants built almost sixty years ago are still operating today at capacity factors that wind and solar advocates can only dream about.

The majority of nuclear plants still use the same reactor design (pressurized water) from the 1950s, but this suggests that current R&D into new nuclear technologies could lead to even higher EROEI plants. As the highest energy surplus technology to convert primary energy (atomic) to useful energy (electricity), nuclear power should be the go-to technology for most of our new electricity production.

Bitcoin Mining: A Tool For Better Energy

Politics aside, by linking Bitcoin mining, the world’s most portable and flexible source of large-scale electricity demand to nuclear, humanity can push its energy surplus to even higher levels. Instead of overbuilding low-EROEI, intermittent renewables like wind and solar, our goal should be to encourage development of high EROEI nuclear generation using Bitcoin mining’s unique attributes as an incentive.

Nuclear power plants require large and stable demand loads given their necessary high capacity factors. Bitcoin mining offers exactly this type of load profile. Using their scale and stability, Bitcoin miners can co-locate with new nuclear projects in order to absorb their electricity production before the plant’s dispatch is fully needed on the grid. Then, given their inherent flexibility and portability, the supportive miners can unplug from one plant and relocate to the next new project. As society’s energy needs continue to grow, we can ensure that this pre-built high-EROEI electricity supply is ready and waiting.

Energy Is The Real Currency

“Energy is the only universal currency: one of its many forms must be transformed to get anything done.”2 - Vaclav Smil, author of “Energy And Civilization: A History.”

Money is just a claim on energy. The problem with fiat money is that it is disconnected from energy due to zero backing by a scarce and energy-based asset, and by constant government manipulation.

Bitcoin, on the other hand, is the purest monetary embodiment of energy to date. It is a clear, direct and unmanipulated claim on energy’s economic value. Bitcoin’s proof-of-work consensus mechanism makes this possible. Being the most decentralized network in the world will ensure it remains this way well into the future. We are only now beginning to understand just how powerful proof-of-work will be in reorienting human effort towards highly positive net energy-producing technologies.

Intermittent energy, as currently pursued by its advocates, will only decrease the world’s current energy surplus, resulting in painful declines in standards of living. It is clear that some electricity-production technologies are superior to others on a net energy basis and without understanding this, our choices will produce severe unintended consequences. The 2022 energy crisis in Europe revealed a more fragile system than we had previously understood and could signal what future conditions will look like — rising costs and intermittent supply.

Thankfully, Bitcoin can fix this. Bitcoin mining paired with development of new nuclear projects can help reverse this course and expand the world’s energy surplus to power the 21st century.

Notes

1 Weißbach et al., Energy 52 (2013)

https://festkoerper-kernphysik.de/Weissbach_EROI_preprint.pdf

Weißbach et al., EPJ Web of Conferences 189 (2018) https://www.epj-conferences.org/articles/epjconf/pdf/2018/24/epjconf_eps-sif2018_00016.pdf

Raw data for chart: http://tinyurl.com/z7329lh

2 “Energy and Civilization: A History,” Vaclav Smil (2017).

3 Some care is advisable when considering EROEI calculations:

First, methodology matters. Is the approach top-down (energy costs derived from fiat costs) or bottom up (energy costs derived from material quantities and manufacturing processes)? The former can easily confuse fiat with energy units giving useless results. The latter, while requiring more effort, is more accurate.

Second, while EROEI is a simple ratio to calculate, there is not yet a standard definition of system boundaries to use when determining the numerator and denominator. Some analysts consider only the fuel costs. Others include the costs of the plant. While still others include the costs of the plant and additional upstream costs incurred to be able to build the plant. Weißbach et al. applied a uniform boundary definition over a full life cycle assessment for each type of power plant. The total energy was also adjusted to utilized energy (exergy) invested and returned for each type of plant. This results in one of the cleanest analyses available.

Third, EROEI is location dependent. Windier locations have greater energy returned on the same energy invested. The same goes for sunnier locations for solar. Fossil fuel plants will also have varying EROEIs depending on their proximity to fuel supplies and the quality of fuel available.

Even the EROEIs of fossil fuels like coal and oil generally decline over time. While the embedded energy in the chemical composition of similar grades of coal and oil are the same between different stocks, the energy required to gather those stocks has historically increased. Newer discoveries are generally farther away from end consumption and require more energy to extract. Today’s deep-water drilling is far more costly in energy terms than drilling was in the East Texas Oil Field during the 1940s when the field was young.

Lastly, like a lot of data analysis, EROEI can be subject to manipulation in order to justify personal biases and political objectives. However, EROEI has value for relative energy surplus analysis. With consistent system boundaries and a defined calculation methodology it offers a standardized way to compare the net energy produced by various power plant technologies without regard to their often distorted fiat ROIs.

This is a guest post by John Thompson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Read more: https://bitcoinmagazine.com/culture/bitcoin-and-nuclear-can-save-the-world

Text source: Bitcoin Magazine: Bitcoin News, Articles, Charts,