Bitcoin Bull Market: Is $45,000 the Magic Level?

The Bitcoin price had to accept high losses in the first 2 months of 2022. But in the last few days and weeks, there have been increasing signs that Bitcoin could re-enter a medium and long-term bull market. The $45,000 mark plays an important role in this. Bitcoin Bull Market Coming On Breaking $45,000?

How has the Bitcoin Price been so far in 2022?

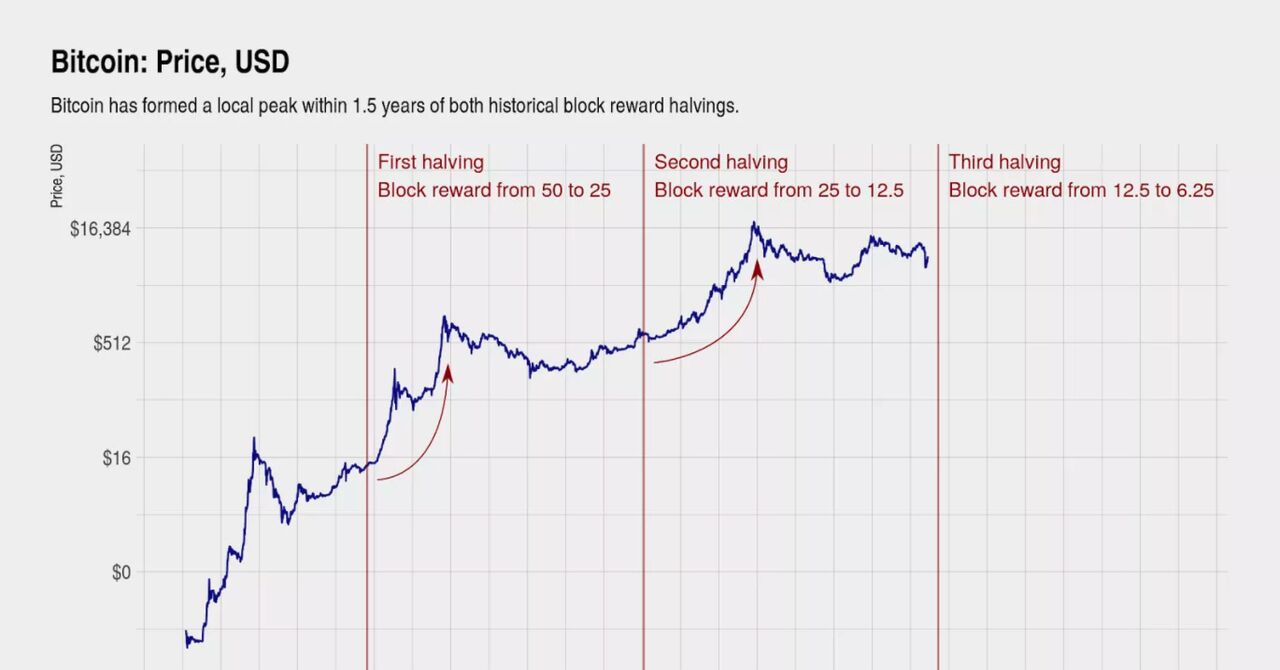

In 2021, many investors were hoping for a massive Bitcoin bull market by the end of the year or in January 2022. Forecast models such as the stock-to-flow model by the famous Twitter user PlanB predicted that the Bitcoin price should rise above $100,000. This was congruent with historical data on the distance between the last bitcoin halving event and the parabolic rise in bitcoin price.

In the past, in 2013 and 2017, there was a massive parabolic increase in the Bitcoin price at the end of each year. 1.5 years ago there was a Bitcoin Halving Event, where the reward for Bitcoin Mining is halved. After the last halving in 2019, it looked like there could be a massive Bitcoin bull market again at the turn of the year 1.5 years later.

Unfortunately, the Bitcoin price could not keep these promises and experienced an extreme downturn in December 2021 and January 2022. Bitcoin was only able to stabilize slightly in February. However, the slide towards $30,000 has been repelled for the time being in the last few weeks.

Why is Bitcoin Down at the start of 2022?

As we touched on, for the past year most analysts have been expecting a Bitcoin bull market in December or January. But this did not occur. The reasons for this are diverse. On the one hand, we have to state that the typical Bitcoin cycle with a parabolic slope at the turn of the year did not repeat itself 1.5 years after the Bitcoin Halving. The Bitcoin cycle has gone haywire.

An important component here is the increased institutional adaptation of bitcoin. More and more large financial institutions are investing in Bitcoin. This ensures that more and more large Bitcoin addresses own a large part of the Bitcoins (Bitcoin whales). These have a greater impact on the Bitcoin price. Furthermore, due to the increasing adaptation of bitcoin to traditional financial markets (bitcoin ETFs), the correlation between the prices on the (American) stock market and the prices of the cryptocurrencies is increasing.

After an all-time high of over $68,000 in November, there were relatively heavy losses in a short space of time. Short-term, speculative investors in particular then sold the Bitcoin relatively quickly. This is how a bearish market situation came about. On the foreign exchange market, too, more and more investors are betting on a price drop in bitcoin (short positions). All of these factors caused the Bitcoin bull market to fail.

What factors will push Bitcoin bull market in the next few weeks?

There are now a few factors that suggest that we will see a significant recovery and a Bitcoin bull market again in the next few weeks:

- The fundamentals of the Bitcoin network are developing very positively. Hashrate rose to new all-time highs even as mining difficulty continues to increase. This shows the strength of the Bitcoin network.

- Transaction activity fell sharply in the last 3 months. However, this figure seems to have recovered in recent weeks.

- Blockchain analytics show that over the past few weeks, large bitcoin addresses (bitcoin whales) and long investors are accumulating bitcoins. These addresses are mostly ahead of the macro trend.

- The "crisis sales" due to the Ukraine conflict and the threat of interest rate hikes seem to be over. The mood on the market seems to be turning. The crises have played out their negative impact on the financial markets.

- Tech stocks (NASDAQ) appear to be rallying, which may have a positive impact on the crypto market .

Why is a Bitcoin price of 45K important?

The Bitcoin price had already scratched the $45,000 mark twice. The first time, a precipitous fall back to $35,000 followed due to the outbreak of war. In the weeks before, however, the Bitcoin price had again recorded massive gains from $35,000 to $44,000. The conflict in Ukraine probably only harmed the recovery in the short term.

If the resistance at $45,000 falls, it is very likely that the trend reversal from Bitcoin's correction since December has finally taken place. The Bitcoin bull market could then unfold again in the coming weeks and months and possibly even lead to a six-digit Bitcoin price with a delay.

You can now buy Bitcoin relatively cheaply on the crypto exchanges and .

Read more: https://cryptoticker.io/en/bitcoin-bull-market-is-45000-the-magic-level/

Text source: CryptoTicker