Crypto Flipsider News – Bitcoin and Crypto Market Sink as USD Rises; Brazil Approves Crypto Regulation; New York Bans Non-Green BTC Mining as Fort Worth Begins Bitcoin Mining; Revolut to Expand to Mortgages, and Crypto Wallets, While Robinhood Downsizes.

Read in the Digest:

- Bitcoin and the crypto market sink as the USD rises, and Dogecoin sees liquidation highs.

- Brazilian Senate Plenary approves bill to regulate cryptocurrencies.

- New York bans non-green BTC mining as Fort Worth begins Bitcoin mining.

- Revolut to expand into mortgages and crypto wallets. Robinhood downsizes as stocks capitulate to all-time low.

Bitcoin and the Crypto Market Sink as the USD Rises, and Dogecoin Sees Liquidation Highs

Bitcoin and the broader crypto market continue their poor performance as sentiment among crypto traders remains mixed. For the first time since March 14th, the price of Bitcoin fell under the key support level of $38,000.

The 24 hour price chart for Bitcoin (BTC). Source: Tradingview

Although Bitcoin is showing signs of recovery, it is yet down 18.5% over the last month.

The 30 day price chart for Bitcoin (BTC). Source: Tradingview

The turbulence being felt in the crypto market has been accentuated by the strengthening U.S. Dollar (USD), which has soared to a two-year high. ApeCoin, ZRX, and Secret currently stand as the only cryptos in the top 100 currently trading in the green.

In related news, Dogecoin (DOGE) is one of the biggest losers of the dip, having dropped in value by 15% over the last 24 hours. Dogecoin’s price drop coincides with higher-than-usual levels of liquidation, as over the last 24 hours, losses on DOGE futures exceeded $34.26 million.

The 24 hour price chart for Dogecoin (DOGE). Source: Tradingview

Flipsider:

- Despite the recent losses in the crypto market, Bitcoin bulls have continued to accumulate BTC.

- According to a report from Arcane Research, institutional investors have continued buying the dip and pumping money into crypto projects.

- The report confirms the bullish stance held by private capital towards the crypto industry in 2022.

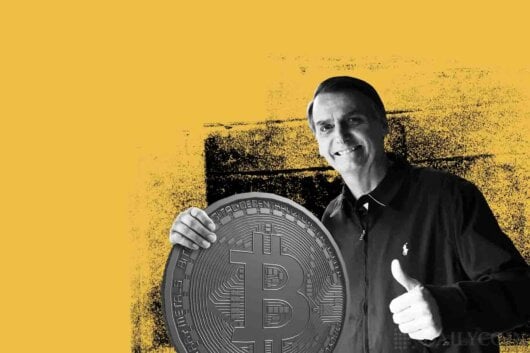

Brazilian Senate Plenary Approves Bill to Regulate Cryptocurrencies

In a noteworthy event the Brazilian Senate has approved the country’s first bill governing cryptocurrencies during a plenary session. The bill aims to create a crypto framework for Brazil’s market, which is the world’s ninth-largest economy in the world.

The Senate confirmed during the plenary session that crypto-asset legislation would be handled by the executive arm of the government. That arm can choose to either create a new regulator, or to delegate power to the SEC or the Central Bank of Brazil (BC).

The bill must first be approved by the Chamber of Deputies before President Jair Bolsonaro can sign it into law. However, the legislation is expected to be completed before the end of this year.

Brazil has also embraced crypto mining by exempting Bitcoin miners from all import charges on ASIC mining machines in an attempt to to draw them into setting up shop in the country.

Flipsider:

- Senator Arns asserted that the punishment for crypto crime should be proportionate to the amount of fraud, money laundering, and other white-collar crimes committed.

Why You Should Care

The bill could increase the adoption of crypto in Brazil and establish its economy as the largest in Latin America.

New York Bans Non-Green BTC Mining as Fort Worth Begins Bitcoin Mining

The New York State Assembly, the lower house of the New York State Legislature, officially passed a bill on Tuesday, April 26th, to end non-green Bitcoin mining.

The bill imposes a two-year ban on all new Proof of Work (PoW) cryptocurrency mining facilities in the state that use carbon-based, mostly gas energy to power their operations.

Established miners in New York using carbon sourced energy will be unable to renew their licenses unless they explore alternate sources of energy. The bill requires Senator Kevin Parker’s approval before Governor Kathy Hochul can sign the bill into law.

Flipsider:

- Fort Worth, a city in North-Central Texas, has become the first to mine bitcoin (BTC) at a governmental level, using three Bitmain Antminer S9 mining rigs donated by the Texas Blockchain Council.

- Mayor Mattie Parker is optimistic, claiming that the city could decide to invest real cash into the mining process after an assessment is made in six months.

Why You Should Care

The crypto industry is strongly against the bill, warning that it may cause miners to relocate, negatively impacting jobs and the “geopolitical interests” of the U.S.

Revolut to Expand into Mortgages and Crypto Wallets. Robinhood Downsizes as Stocks Hit All-Time Low

Banking app Revolut has announced that it is working to expand into the mortgage and cryptocurrency wallet sectors.

The company revealed that it is also exploring the possibility of expanding its remittances services, and rolling out a buy now, pay later (BNPL) offering. Revolut currently offers payments services, crypto, stock trading, and savings accounts.

Revolut CEO, Nik Storonsky, has said that the expansion will help the company become a one-stop financial services provider—or a “super app.”

Flipsider:

- As Revolut looks to expand its services, popular retail trading platform Robinhood has been forced to let go of 9% of its workforce.

- The downsizing at Robinhood is the result of a plunge in Robinhood’s (HOOD) share prices.

- Over the last 30 days, HOOD has tanked roughly 38% of its value to sit at $9.99 – an all-time low.

Why You Should Care

Super apps are growing in popularity worldwide, and experts believe that wallet integration could help to increase the adoption of crypto.

Text source: DailyCoin.com