Crypto Flipsider News – BNB Chain Hacked; Grayscale BTC Mining; MakerDAO Invests in Bonds; CME Crypto Indices; Celsius Discloses User Data

Read in the Digest:

- Binance Smart Chain resumes operation after $570 million theft in exploit

- Lending giant MakerDAO to invest $500 million in treasuries and bonds

- Grayscale launches new investment vehicle focused on Bitcoin mining

- CME Group to launch 3 new crypto reference rates and real-time indices

- Celsius court filing discloses thousands of customers’ transactional data

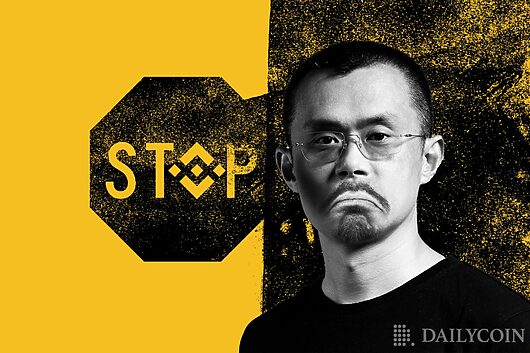

Binance Smart Chain Resumes Operation After $570 Million Theft in Exploit

Binance Smart Chain, the blockchain network of the world’s largest cryptocurrency exchange, was targeted on Thursday, October 6th, leading to Binance temporarily suspending every operation on the chain.

In a blog post, Binance announced that a cross-chain bridge linking with its BNB Chain was targeted. According to the report, approximately 2 million of its BNB tokens, worth $570 million, were stolen in the hack.

After identifying the threat, Binance worked with transaction validators on the BSC to pause the creation of new blocks, suspending all transaction processing while a team of developers investigated the breach.

The exploit was enabled “through a sophisticated forging of the low-level proof into one common library.” However, with the issue now fixed, Binance has resumed entire operations on the Binance Smart Chain.

Flipsider:

- Binance said it managed to freeze $7 million of funds with the help of its security partners, and its users’ funds were safe.

Why You Should Care

The total funds lost could be smaller than reported as Binance actively works with other projects to freeze funds as the hacker moves them around.

Lending Giant MakerDAO to Invest $500 Million in Treasuries and Bonds

Decentralized finance (DeFi) lending protocol MakerDAO announced on October 6th that it has reallocated $500 million from stablecoin Dai (DAI) collateral reserves to invest in treasuries and corporate bonds.

According to MakerDAO, 80% of the $500 million will be invested in short-term US treasuries. The 0-1y US Treasury iShares ETF and the 1-3 year U.S. Treasury iShares exchange-traded fund (ETF) from BlackRock will be allocated $160M and $240M, respectively.

The remaining 20% will be made in investment-grade corporate bonds provided by investment management firm Baillie Gifford. Digital asset bank Sygnum announced it is the lead partner in the $500 million diversification effort.

Digital asset bank Sygnum announced that it is the lead partner in the $500 million diversification effort and is partnering with BlackRock Switzerland to allocate $250 million in the plan’s first phase.

Flipsider:

- The move contradicts MakerDAO’s co-founder Rune Christensen’s advice that DAI de-peg from USDC and shift into a truly decentralized crypto.

Why You Should Care

MakerDAO aims to diversify the holdings currently collateralizing DAI into a scalable legacy finance investment, limiting significant risk to the stablecoin peg.

Grayscale Launches New Investment Vehicle Focused on Bitcoin Mining

Grayscale, the world’s largest crypto asset manager, has unveiled a new investment vehicle to help investors capitalize on the reduced prices of Bitcoin (BTC) mining infrastructures.

Grayscale announced the launch of the Grayscale Digital Infrastructure Opportunities LLC (“GDIO”) on October 6th. Grayscale partnered with Foundry to operate GDIO’s day-to-day activities for the new investment vehicle.

The entity is now available for accredited individuals and institutional investors at a minimum stake of $25K. Funding for the new Grayscale vehicle is expected to end before the turn of the year.

The funds raised through the investment vehicle will be used to buy new and old mining equipment at discounted prices. In return, earned bitcoin would be distributed to investors as a cash dividend.

Flipsider:

- According to a recent filing, Grayscale has terminated two agreements with cryptocurrency broker Genesis around its Grayscale Bitcoin Trust.

Why You Should Care

Grayscale, with this vehicle, seeks to capitalize on the low crypto prices as part of its plans to lower the barrier for investors to enter into the crypto space.

CME Group to Launch 3 New Crypto Reference Rates and Real-Time Indices

The world’s largest derivatives exchange, CME Group, has announced plans to launch three new cryptocurrency reference rates and real-time indices. CME is partnering with leading crypto index provider CF Benchmarks on this initiative.

Avalanche (AVAX), Filecoin (FIL), and Tezos (XTZ) are the three new cryptocurrencies to be added by CME. Their reference rates and indices will be calculated and published daily by CF Benchmarks, starting October 31st.

The new reference rates will provide the U.S. dollar price of AVAX, FIL, and XTZ. The rates will be published once a day at 4 p.m (London time).

In addition, their respective real-time index will also be published every second, every day of the year. However, these reference rates and indices are not tradable futures products.

Flipsider:

- CME Group has reportedly filed paperwork to become a futures commission merchant (FCM) but awaits approval from the Commodity Futures Trading Commission (CFTC).

Why You Should Care

Adding AVAX, FIL, and XTZ means CME CF offerings now cover more than 92% of the global crypto market cap.

Celsius Court Filing Discloses Thousands of Customers’ Transactional Data

In a filing at the United States Bankruptcy Court of the Southern District of New York dated October 5th, bankrupt crypto lender Celsius revealed the transactional information of thousands of its customers.

The document, which was over 14,500 pages, revealed Celsius customers’ names, their transaction types, amounts (USD and type of cryptocurrency used), quantities of tokens held, timing, and more. However, the addresses of customers were redacted.

The filings also revealed the $17 million worth of crypto that Celsius’ top executives – former CEO Alex Mashinsky, former chief strategy officer Daniel Leon, and chief technology officer Nuke Goldstein – withdrew weeks before the customers’ assets were frozen.

Flipsider:

- Even with the forthcoming auction on October 17, Celsius will not offset its obligations of over $6.7 billion with its $3.9 billion worth of assets.

Why You Should Care

The disclosure has received criticism, with experts stating that bad actors can match the dates and amounts to the corresponding blockchain transaction data to dox Celsius’ users’ on-chain activity.

Text source: DailyCoin.com