Discussing The Macroeconomic Trends Impacting Bitcoin In 2021 And 2022

A review of the biggest macroeconomic developments that impacted bitcoin last year, and those that will shape it in 2022.

Listen To This Episode:

In this episode of Bitcoin Magazine’s “Fed Watch'' podcast, Christian Keroles and I recorded live on YouTube as part of the magazine’s near-daily live stream. This week, we reviewed the major trends and news items of 2021 and then dive into predictions for 2022 trends.

Bitcoin And Macro Review For 2021

Keep in mind that many things happened in Bitcoin this year, but these were the biggest trends and events from a currency/macroeconomic perspective.

First and foremost, we have El Salvador’s move to add bitcoin as legal tender alongside the U.S. dollar. It was announced at the Bitcoin 2021 conference in Miami and instantly drew applause from bitcoiners as well as criticism from traditional gatekeepers like the International Monetary Fund (IMF) and World Bank. We spent a few minutes discussing different aspects of the El Salvador news and President Bukele himself. If there was a “Bitcoin Man of 2021” it would probably be him.

The second most influential event of 2021 was the China Bitcoin ban. After years of flip-flopping with partial bans, the Chinese Communist Party (CCP) finally did it and banned bitcoin services and businesses in May. This led to an exodus of bitcoin miners from China, mainly to other countries in Central Asia and the U.S. The other half of this story therefore is the rise of the bitcoin mining industry in the U.S. The U.S. has always been home to many bitcoin miners, but now the U.S. is the largest mining country in the world; a title it likely won’t give up for decades to come.

No review of 2021 would be complete without including the supply chain issues and what most people call “inflation.” This was definitely a main topic in 2021 in macroeconomics — the economy peaked at the end of the first quarter and the rest of the year was dominated by slowing fundamentals and rising prices.

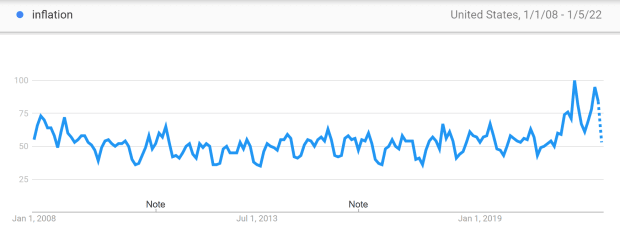

A quick look at Google Trends since the Great Financial Crisis (GFC) shows global interest in the term “inflation” reached its highest since then, and in the U.S. in particular, the worry about inflation was greater than the GFC when the Federal Reserve started on this current path of Quantitative Easing (QE).

You could hardly go a day in the second half of the year in financial circles without inflation being the main topic. However, notice that this was also the worst disruption of supply chains in the last 75 years. Much of the world was locked down for months in 2020 and 2021, no wonder prices rose modestly. But what is surprising is that the price increases weren’t more dramatic. Several months of close to 1% inflation caused all this?

Finally, for 2021 we discussed the trends in stablecoins and altcoins. Last year, we witnessed a clear decoupling in both of these areas. For stablecoins, we saw the Fed break with the European Central Bank (ECB) and other central banks by not demonizing stablecoins and stiff-arming central bank digital currencies (CBDCs). This highlights a fundamental conflict of interest arising between central banks around the world. As for altcoins, they have decoupled from the typical relationship with bitcoin. In previous eras, altcoins would pump and be dumped for bitcoin, however, NFTs, which are much less liquid than a currency-type altcoin, are not easily dumped for bitcoin. This traps value in scams and stops bitcoin from benefiting from the cycles of extreme speculation.

Bitcoin And Macro Predictions For 2022

Now, to some fun stuff. If you are a regular listener of “Fed Watch,” many things won’t surprise you. Here are the highlights, but you’ll have to listen to hear all of our predictions.

We think the most dominant trend for 2022 will be a rising crisis in Europe. The European debt crisis started very quickly after the GFC, and in the current financial crisis, we expect to see a European debt crisis 2.0. That’s a big deal as Europe’s relationship with the U.S. and Fed are cracking, and some internal fractures are starting to show.

A more specific political prediction we have for 2022 is that the media and politicians will start moving more to the center. This is in line with the Fourth Turning timeline, the multi-generational cycle that ends with a return to the center politically and revamping institutions and society. Those countries that are not able to “reform” (I’m looking at you CCP and Brussels), will face high levels of civil unrest or revolution. 2022 is the year this becomes clear.

The coming year will also see at least one more country adopting bitcoin using the blueprint of El Salvador. We speculate on which countries this could be. I brought up the Latin American countries of Ecuador and Panama because they both use the USD similarly to El Salvador. Keroles brought up the African country of Tonga. There are many options, some of them already showing interest in bitcoin.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Read more: https://bitcoinmagazine.com/markets/macroeconomic-trends-impacting-bitcoin-in-2021-and-2022

Text source: Bitcoin Magazine: Bitcoin News, Articles, Charts,