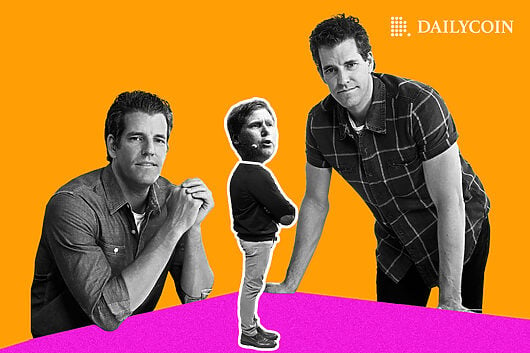

Gemini’s Winklevoss Accuses DCG CEO Silbert of Fraud, Demands His ‘Immediate’ Removal

Crypto exchange Gemini co-founder Cameron Winklevoss has released another open letter, this time to the board of Digital Currency Group (DCG). In the letter, published on Twitter on Tuesday morning, Winklevoss said that Genesis, DCG, and its founder and CEO Barry Silbert defrauded Gemini and its 340,000 Earn program users by making false statements about the solvency and financial health of Genesis. He asked the DCG board to “immediately” remove Silbert from the company. Winklevoss also claimed that Silbert and other key DCG personnel lied about DCG having absorbed Genesis’ massive losses linked to the crypto hedge fund Three Arrows Capital (3AC) and its bankruptcy last year. In particular, Winklevoss said that after Genesis lost $1.2 billion – or approximately 15% of its loan book’s assets – after 3AC blew up following the implosion of Terra Luna, it decided not to go the debt restructuring path but instead “embarked on a carefully crafted campaign of lies” to convince its customers that DCG had indeed absorbed Genesis’ losses. Winklevoss claimed that “multiple Genesis and DCG personnel began doubling down with more lies.” He explained that Gemini had received a document from Genesis’ then-Head of Trading and Lending Matthew Ballensweig showing the 10-year promissory note under “Current Assets.” That, according to Winklevoss, was accounting fraud since the promissory note couldn’t be converted into cash or other assets could can be converted into cash within one year. On top of that, Winklevoss said that the actual value of the unsecured long-dated promissory note was around $300 million, not $1.2 billion. Winklevoss also offered his explanation of how Genesis managed to lend $2.36 billion to 3AC. According to him, Genesis was inclined to lend to 3AC because the hedge fund used the borrowed money for the “kamikaze” Grayscale GBTC trade that “ballooned” the AUM of GBTC and generated a lot of fees for Grayscale, which DCG wholly owns. This worked as long as the value of GBTC shares was more than the underlying Bitcoin. When the value of the shares started to go down in 2021, Genesis started to lose this trade. On top of that, Winklevoss claimed that the lender participated only in the losing side of the trade because it “always ceded the GBTC share premium to 3AC.” However, Winklevoss said that Genesis continued to lend to 3AC even after the premium inverted. He said Genesis did so because the Bitcoin that makes up the GBTC fund can’t be redeemed. Winklevoss also said that Genesis hid the risk swaps by “mischaracterizing the first and last legs of these swaps transactions as collateralized loans on its balance sheet.” He also called it accounting fraud. DCG’s problems became even more complicated when Bloomberg reported that the U.S. Department of Justice and the Securities and Exchange Commission (SEC) were investigating the crypto conglomerate. According to Bloomberg, Silbert’s DCG has received requests for documents and interviews related to internal transfers at Genesis. A DCG spokesperson said that DCG is unaware of any active investigations into the company. Genesis’ issues came to light in late November last year when the lender halted loan redemptions and new loan issuances. Hours later, Gemini, which used Genesis as its lender platform, also halted withdrawals for its 340,000 Earn program users who now have over $900 million stuck on Gemini. Since then, neither DCG nor Genesis has moved to solve this problem. Gemini’s Winklevoss had issued an ultimatum to Silbert to publicly commit to solving this issue by January 8, but the DCG boss failed to do so. DCG and Genesis are among the largest crypto companies in the industry. Going under might mean more pain to crypto users and investors in the short term. You Might Also Like: Barry Silbert’s DCG Faces SEC and DOJ Investigation Over Internal Transfers

“DCG had not ensured that Genesis had the capital to operate. In fact, DCG hadn’t given Genesis so much as a penny of actual funding to make up for the 3AC losses. Instead, DCG entered into a 10-year promissory note with Genesis at an interest rate of 1% – due in 2023. This note was a complete gimmick that did nothing to improve Genesis’ immediate liquidity position or make its balance sheet solvent,” he explained.

Accounting Fraud Accusations

“These misrepresentations (repeated in many documents sent to Gemini and other lenders over the following months) were a sleight of hand designed to make it appear as if Genesis was solvent and able to meet its obligations to lenders, without DCG actually committing to the financial support necessary to make this true. DCG wanted to have its cake and eat it too. And Barry and DCG might have gotten away with it, if not for the FTX collapse,” he said.

Grayscale’s Involvement

“Things only begin to make sense when you realized that the Bitcoin this swap was stuffing into the Grayscale’s Trust like a Thanksgiving turkey is stuck there forever. It can never be redeemed (or at least until Grayscale, in its sole discretion, decides to implement a redemption program allowing GBTC shares to be converted back into Bitcoin. As a result, Barry was comfortable with Genesis loading up more and more on this toxic trade because it was a gambit to feed the Grayscale’s Trust – Barry’s financial Hotel California that would print money for the DCG universe in perpetuity. The end would justify the means,” Winklevoss explained.

Investigation by U.S. Authorities

On the Flipside

Why You Should Care

Read more: https://dailycoin.com/geminis-winklevoss-accuses-dcg-ceo-silbert-of-fraud/

Text source: DailyCoin.com