He Fell Victim to Crypto Romance Scam: What’s Waiting Ahead?

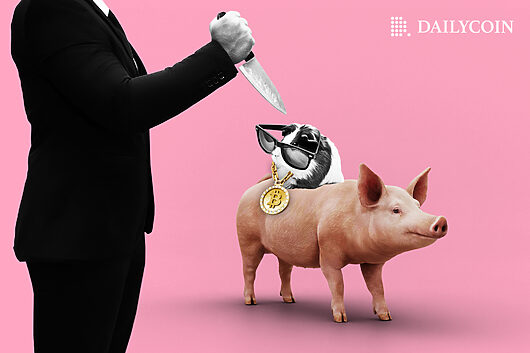

“I am over 40 years old, live alone, have a well-paid job and a seasonal business. I’ve been investing for nearly 20 years, lately was practically living on a passive income. Now I’m starting afresh with zero in my account”, says Marijonas. He is one of the numerous victims of the so-called pig butchering scheme, the fast-emerging type of online scam that combines romance and business. Survivors of similar crypto scams are skeptical about the odds of getting their money back. Let’s see if the situation really is that gloomy or if there is even a bit of hope. As unsexy as it may sound, pig butchering is a new breed of romance scam that involves fake online lovers, fake investment platforms, fake brokers, and real-life losses. Its name originates from the Chinese “sha zhu pan,” which means “pig butchering.” The scam derives this unusual name from its resemblance to the pig slaughtering process. The fraudster initiates contact with their target (“the pig”) on dating apps, social media platforms, or via “wrong number” text messages. The scammer gains their trust, creates the illusion of a relationship, and lures the victim into fake crypto investments that can never be withdrawn. Ironically, the vast majority of pig butchering victims are intelligent and tech-savvy people. “Romance scammers often appear as attractive, wealthy, and successful business people looking for serious relationships. They approach victims on dating apps or social media and start intimate online relationships,” shares Marijonas, a romance scam victim from Lithuania, Europe’s emerging fintech hub. Months ago, he “matched” with attractive jewelry maker Irina on Tinder. She messaged him first and then offered to switch to WhatsApp. Her Tinder profile linked to her Instagram, which had 500 followers, was active, displayed her luxurious lifestyle, and looked legit. “You get the impression that you are lucky enough to meet a girl that you don’t even expect,” the man says. Like him, Irina was involved with investing. She said that 70% of her income even came from investments. The woman shared an investment account with her brother, a financial analyst. He made successful leverage trades based on insider info that his boss, Nikolay, shared with them for a 23.5% quarterly fee. Irina mentioned the Aplore investment platform, registered in Romania and operating under the license of Cyprus, which had no previous online history. Marijonas registered an account, spent €10K to buy Bitcoins on the Huobi exchange, and transferred them into his Aplore trading account. “We started investing: I logged in and shared my screen via Skype, and he told me what positions to open. We started with currency pairs. Profits increased in front of my eyes. I earned over €3K during the first week,” said the man. But as soon as their victims get hooked, pig butchering scammers change tactics and increase pressure to invest more and more. Obstacles impede every attempt to retreat. Nikolay and his team encouraged Marijonas to trade with higher leverage, which is available for accounts above €50K. “I couldn’t resist the temptation to earn more and transferred another €40K,” he noted. After that, he received a call from the platform’s support, claiming that capital above €50K must be insured from high-leverage risks. An additional 30% of the amount must be transferred in three days; until then, he was locked from trading. Transactions were halted each time Marijonas tried to move assets out of his trading account. The platform’s support blamed the smart contract, which would only re-activate after a deposit worth 29% of the account’s total value. “I think there was something like NLP. They have all the answers to all the questions ready. Why is there no address? Binance doesn’t have either. Why bad reviews? Competitors write them. Why is there no license register? The register of blockchain companies is not made public. I thought that these people are just taking risks by choosing an obscure intermediary,” says Marijonas. Eventually, he sold all his stocks and put the required amount into a platform. His deposit grew up to nearly €150K. “I was left barefoot,” he confessed. Meanwhile, the crypto romance scammers kept up the pace. On the contrary, they continued coming up with new arguments about why additional funds needed to be added to their victim’s trading account. Following the theory of sha zhu pan, the time when the scammer’s sentiment changes marks the process’s final stage. They start blaming the victim, requesting fees, and finally cutting it off. Three months after meeting Irina on Tinder, the pressure on Marijonas started. “Deposit the money, take quick credits. After that, the platform simply disappeared. Almost €150K was washed away,” says the victim. His new acquaintances became unreachable too. Instead of a goodbye, Marijonas received a fake email impersonating the UK Financial Conduct Authority (FCA), an institution that regulates the financial services industry in Great Britain. The letter offered a way to get back 75% of his lost funds in exchange for statements of his trading account and ID documents copies with a selfie attached. “Neither the girls nor the investment advisors ever do video chats,” says Marijonas. His post-scam research revealed that scammers steal the identities of existing public profiles registered in a different country than the victims. According to him, “the name of the fraudster matches the name of the person from whom the photos were stolen.” Falling for a love scam and losing your life savings is traumatic. We go through a range of extreme emotions: shock, guilt, shame, anxiety, self-doubt, and anger. But while some shut down in shame and despair, others desperately search for ways to get their money back. This is when they are most susceptible to falling for new scams, offering ways to recover lost money. The US Federal Trade Commission (FCA) confirms that recovery scammers create websites posing as fraud recovery companies, government officials, or lawyers. They promise to get victims their money back and ask them to pay before receiving services. According to the FCA experts, the upfront payment request is a warning signal, and the only way to not fall into a scam again is to refrain from making even the smallest payment before getting the service. Scam victims may reach out to lawyers for help. Although getting your funds back from scammers might be difficult, the chance always exists, says Edvardas Jankauskas, legal counsel of Swiss company Isun AG. Some jurisdictions, like the United Kingdom, have Financial Ombudsmen institutions that help victims request compensation from a bank or payment provider if the financial institution has not warned the user about their unusual outbound transaction. However, an ombudsman’s assistance is highly dependent on the jurisdiction in which they operate. Banks typically have safeguards in place and warn customers about potentially unusual transactions. Meanwhile, filing a theft report becomes complicated if the company is fake and provides no information about itself. “If you fell victim to bogus scam company, the refund chances are almost zero,” states Marijonas. The third category of paid helpers is companies that provide on-chain money-tracking services. The public nature of blockchain allows us to follow the transactions of the scammers’ crypto wallet addresses. “The problem is determining which crypto exchange has a wallet into which the stolen assets were deposited. That is the kind of information those companies provide for a good price,” says Marijonas. “In my case, the money went to their wallet on Huobi. The exchange requests a court decision to seize it and provide to provide owner’s data,” he adds. Law enforcement institutions are the only real help that romance scam victims may expect, believes Marijonas. At the same time, he agrees that police, especially on European soil, lack the knowledge and tools to deal with crypto-related investment frauds. DailyCoin asked Nils Andersen-Röed, the Deputy Head of Financial Crime Compliance at Binance and former Europol officer, what stops mitigating crypto crimes more effectively. According to him, the collaboration between law enforcement, financial institutions, and the crypto industry is crucial. “Quite often law enforcement is only looking at one particular victim in a certain jurisdiction, while we see requests from all over the world. We can compare the modus operandi of linked accounts. If we see those links, we do engage with law enforcement and try to connect law enforcement with each other. In my experience, it’s much more powerful to counter the whole network instead of looking just into the individual cases,” says Andersen-Röed. Accordingly, he believes that society prevention awareness is no less critical. Victims tend to rely on someone with whom they have a trusted relationship and thus invest in scams like pig butchering. Since its birth in 2019, pig butchering has become a prevalent romance scam type worldwide. At least 4,300 crypto victims were registered by the FBI in 2021, each losing close to $100K on average. The size of their average losses climbed to $155,000 by the middle of 2022. Over 50% of the victims lost more than half of their net worth to pig-butchering scammers. More than a third were driven into debt. At the same time, the absolute majority (88%) reported having a university degree. This leads to the conclusion that anyone can be deceived. We all have specific psychological weaknesses. Even the most rational person may behave recklessly when a scammer gets hold of them.What is a Pig Butchering Romance Scam?

How the Scheme Works

Step 1: “Finding the Pig”

"Honestly, I earned up to 10% per year from my investments, while she got that and more per month. The 23.5% was worth trying. There was nothing unusual about it," said Marijonas.

Step 2: “Fattening the Pig”

Step 3: “Butchering”

The Morning After: Who’s There to Help You?

"Same criminals who have already scammed you try to trick you out of even more money by promising to help you get your funds back," claims Marijonas.

Lawyers and Financial Ombudsman Services

“First, it is necessary to identify who runs the fake platform. If a company or individual is identified behind it, the victim needs to contact the police of the jurisdiction where the firm is registered and file a report of theft or fraud. Then, if those persons or companies are found, it would be possible to get your funds back. Of course, every case is different and needs to be assessed properly,” says the lawyer.

Blockchain Trackers

Law Enforcement

"It's very hard to teach people. It's hard to convince those people [victims] that they are actually participating in the scam because they truly believe the story," says the Deputy Head of financial crime compliance at Binance.

Bottom Line

Read more: https://dailycoin.com/he-fell-victim-to-crypto-romance-scam/

Text source: DailyCoin.com