Is The Worst Over for SOL After a 56% Weekly Crash Following FTX Fallout? (Solana Price Analysis)

Because of its ties to Alameda Research, the trading firm of Sam Bankman-Fried, Solana suffered a massive crash. While the cryptocurrency recovered a bit over the past couple of days, the question remains if the worst is over for SOL.

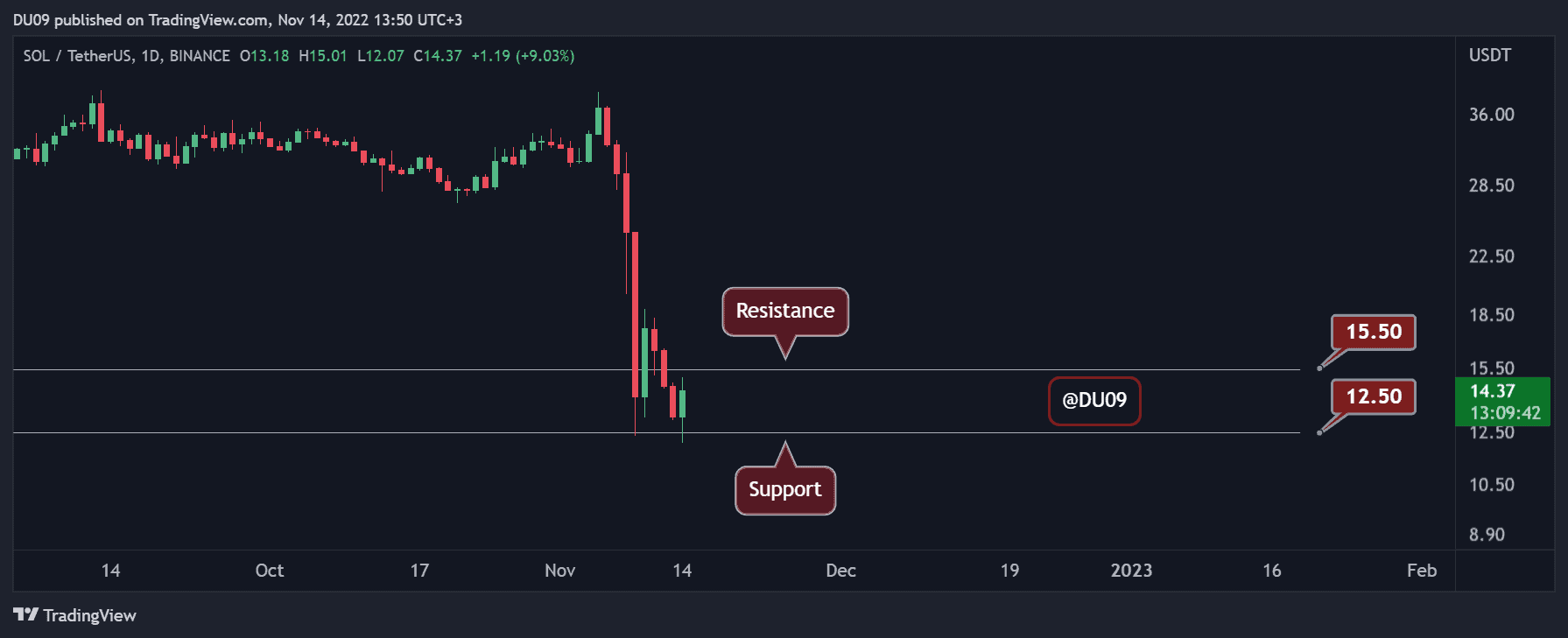

Key Support level: $12.Criticaley Resistance level: $15.5

Solana crashed from $38 to $12 as the troubles of FTX and affiliated trading firm Alameda Research amplified. This is because the latter was one of the largest investors and holders of SOL. The price has managed to find some support at $12, but the sell-off may not be over. The current resistance is at $15, and buyers seem absent.

Technical Indicators

Trading Volume: The daily volume exploded and peaked on 9th November when sellers liquidated a large number of tokens.

RSI: The daily RSI fell to 23 points during the sell-off but has recovered somewhat since then and is now found above 30.

MACD: The daily MACD remains bearish, and the histogram is turning flat. This shows that the initial wave of sellers has been exhausted.

Bias

The bias for SOL is bearish.

Short-Term Prediction for SOL Price

The market remains extremely fragile, and any bearish news could push Solana even lower. The current support is not particularly strong, and the price may fall lower if sellers return. If so, the cryptocurrency could fall under $10.

The post Is The Worst Over for SOL After a 56% Weekly Crash Following FTX Fallout? (Solana Price Analysis) appeared first on CryptoPotato.

Text source: CryptoPotato