The Roads To Hyperbitcoinization: Describing The ‘Transition Agents’ Bringing Us Financial Freedom

These bottom-up “transition agents,” from private business to the freedom ladder, will be what drives us all to hyperbitcoinization.

This article is the second part in a series where we outline the views and predictions made by the Bitcoin community concerning the prospect of hyperbitcoinization. In our analysis, we highlight "transition agents": main players, groups of players or institutions that could accelerate the transition to a Bitcoin world. For each topic, we base our arguments on the references collected, and if possible, present data that aims to assess the probability of this outcome.

The first article described top-down scenarios initiated by institutional agents or governments whose influence is expected to trickle down to a wider audience. We identified monetary inflation and the rollout of central bank digital currencies (CBDCs) as probable scenarios initiated by central banks, while bitcoin hoarding, a rise in cross-border payments in bitcoin, bitcoin as a legal tender and even the advent of a hash war were identified as scenarios likely to induce government acceptance of Bitcoin. In view of the recent pronouncement by El Salvador, it appears that political agendas in South America are in a state of flux, in particular in countries with national elections scheduled for 2021 and 2022.

This second article aims at understanding of bottom-up type initiatives carried out by businesses, communities and individuals.

Bottom-Up Scenarios

We identified several notable hyperbitcoinization scenarios that emanate from two large groups of actors. The first group represents private-sphere-led initiatives brought together by established firms and startups. The second group is composed of grassroots initiatives mostly impulsed by the Bitcoin community whose main purpose is to educate and help new users to be onboarded. The article begins with a discussion of the initiatives driven by these two groups before turning to an examination of emerging individual behaviors. In this article, we have followed the principle of methodological individualism, well-known in the Austrian school of economics, which consists in explaining large-scale social phenomena based on subjective individual actions and motivations.

Private Sphere

Figure one depicts scenarios initiated by private actors that could — intentionally or unintentionally — set off a chain of events driving to hyperbitcoinization.

Business Adoption

Since inception, Bitcoin has demonstrated that it offers a wide variety of benefits to users. Its value proposition as a safe haven for individuals is without question one of its key enduring narratives. In August 2019, the world was surprised when MicroStrategy (MSTR), a NASDAQ-listed public technology company, announced that it was converting part of its cash reserves into bitcoin. Figure two depicts publicly-traded companies that reported owning bitcoin on their balance sheets or have converted a fraction of their cash reserves to bitcoin over time.

To date, we can divide this trend into four distinct areas:

- Quadrant I is composed of early-adopter companies that have held bitcoin for several years. It includes Bitcoin mining companies (GLXY, MARA, RIOT) that, historically, have bet on the long-term appreciation of the asset. As they grow, these companies will naturally move into Quadrant II.

- Quadrant II is territory personified by MicroStrategy, which has suddenly converted a large part of its reserves denominated in USD into bitcoin and keeps on purchasing more bitcoin recurrently. The company value seems to be strongly correlated with its bitcoin holdings (60%).

- Quadrant III contains the innovators: companies like Tesla and Square (now Block) that have converted a relatively small fraction of their reserves into bitcoin and may increase their exposure in future.

- Quadrant IV is probably not reachable for most companies. It would imply large companies with valuation exceeding $100 billion getting more than 50% of their reserve in bitcoin. If it happens, the amount of capital allocated into bitcoin will approximate trillions of dollars.

Since the MicroStrategy announcement, many other companies have started to display an interest in Bitcoin, and we can expect to see more of these kinds of initiatives appearing over the coming months once decision-makers have weighed their choices.

If hyperbitcoinization comes to fruition, the revenues, costs, profits and valuations of all companies could be accounted for in bitcoin (Mimesis Capital and Burnett), and most valuable companies would be the ones holding the largest chunks of bitcoin on their balance sheet.

Private Coin

When Meta (formerly Facebook) announced in 2019 that it would be launching a new digital currency, Diem (originally called “Libra”), the move caught governments and financial institutions alike off-guard. Diem’s stable value was to be derived from a basket of fiat currencies (U.S. dollar, euro, Japanese yen, British pound and Singaporean dollar) that would allow any Facebook user to send money as easily and intuitively as sending a message.

Although an appealing idea in many ways, concerns were raised in some quarters about trusting a company that feeds on user data. Some feared Diem would embody the worst of monies and data privacy practices. On the other hand, the launch of a private digital currency like diem may serve to familiarize large numbers of users with this emerging technology and thereby act as an on-ramp to broader Bitcoin adoption. As users get acquainted with digital currencies, they will develop an understanding of bitcoin as a scarce, censorship-resistant and decentralized digital money.

10x Factor

Bitcoin is often considered a better form of money because it combines significant improvements in terms of portability, divisibility or fungibility when compared to both past and present forms of monies, along with bringing radical disruption in terms of resistance to censorship and fixed supply. One aspect that remains underexplored is transaction costs on the economy.

Over the centuries, people have cooperated to minimize transaction costs and produce more efficiently what they are unable to produce individually. The theory of the firm by Ronald Coase describes the relationship between internal and external costs.

When a firm’s external transaction costs are higher than its internal transaction costs, the company will grow. If the external transaction costs are lower than the internal transaction costs the company will downsize by outsourcing, for example.

Applying this theory to the banking sector, we can project that the Bitcoin protocol is likely to capture a significant portion of the banking industry value proposition, and it is not hard to imagine that it could probably capture it entirely once the Bitcoin stack becomes a more tangible reality (see figure three). Over time, we can expect the value created on top of the Bitcoin stack to first capture the value of the financial industry, and then surpass it.

If the transaction costs incurred by Bitcoin users are lower than transactions enabled by conventional payments rails, demand will shift to the cheaper channel. Following Brexit, Visa and Mastercard increased their interchange fees by almost 1%, squeezing merchants’ bottom lines even further. This has also occurred in Colombia, where merchants stopped using debit and credit cards to avoid the excessive fees.

Elsewhere, merchants who want to reduce interchange and swipe fees, may also consider other payment options such as the Lightning Network as a means of reducing costs. Payment service providers risk entering a death spiral initiated by a shrinking customer base placing pressure on profit margins and ultimately rendering their services less competitive. In the context of increasing compliance costs in the banking and payment industries, the likelihood of this scenario cannot be ignored.

Transaction costs represent just one of several key aspects in the battle between established companies and Bitcoin-native services. In terms of remittances, in a recent research article, Bitrefill found that convenience and speed were as important — if not more so — than cost for some customer segments. Looking at the sophisticated process of sending remittances in Nigeria, they determined that the entire process would be reduced to 20 to 30 minutes from the several days it typically takes to send conventional cash-based remittances. Even if 30 minutes sounds like a long and painful experience in today’s financial world, it represents a ten-fold gain compared to cash-based remittances.

Even if we could argue that Bitcoin doesn't exhibit yet the same number of transactions as large payment service providers, the payment infrastructure has grown at a rapid pace to the point of surpassing PayPal in terms of volume of transactions in 2021 and to present a viable alternative to existing payment rails (see figure four).

This adoption is illustrated by the increasing number of Bitcoin transactions observed in Nigeria. According to Bernard Parah, CEO of Bitnob, the transaction volume observed in Nigeria is driven primarily by businesses and commerce. Domestic controls on capital imposed by the Nigerian government considerably limit the capacities of individuals and companies to trade internationally. Lacking access to U.S. dollars, a mechanical company wanting to buy spare parts from China, for example, would not be able to find a seller because no one would accept the naira as a form of payment. The use of Bitcoin — either directly or through a third party who can pay a prospective seller in yuan — creates a credible alternative means of payment that thereby opens access to the global marketplace for our Nigerian mechanical company.

These ten-fold factor examples highlight the role of transaction costs, but this is not to downplay how ecosystem startups also need to pay attention to transaction reliability and to the overall user experience, especially concerning self-custody services that differentiate from custodial services and their onboarding processes dictated by regulation and compliance.

Broader Public Attention

Long seen as the ultimate safe haven in the crypto world, bitcoin is still finding its way as a medium of exchange.

While, in theory, whales and original gangsters (OGs) have had enough time to accumulate significant portions of bitcoin, the purchasing capacity of newcomers is limited by current price. The accumulation of satoshis is therefore the only option for those wishing to become familiar with this new asset class. Programmed regular purchases such as dollar-cost averaging (DCA) or loyalty programs offering cashbacks in satoshis are two options for earning bitcoin that are gaining in popularity.

The progressive integration of Bitcoin services into social networking and e-commerce platforms — or even games for which frequent microtransactions are familiar experience — could have the potential to onboard a large, digitally-savvy customer base in a short period of time.

Big tech companies already offer services to several hundred million or even billions of people worldwide (figure five). If any of these companies were to start accepting bitcoin as a means of payment, this would immediately trigger interest in the technology from a population that had little to no prior exposure to cryptocurrencies. Twitter’s announcement that it had developed a Lightning Network tipping function that would help people send money frictionlessly is illustrative of how large social media firms might leverage the reach of their networks.

E-commerce companies could also play a major role in spreading Bitcoin use. As Tim Draper pointed out, consumers have already been buying products indirectly with cryptocurrencies for years with the purchase of vouchers and gift cards redeemable on e-commerce platforms representing the largest number of payments (figure six).

A Rakuten case offers an analogy of how fast a large e-commerce actor can scale up a new payment technology through its user base. By allowing customers to pay by credit card, and gradually capturing payments made outside of their own platforms, over time Rakuten has become one of the largest credit card issuers in Japan.

Financial World

Over the last decade, Bitcoiners have regularly hypothesized how events initiated within the financial industry might accelerate the visibility of Bitcoin, such as the introduction of exchange-traded funds (ETFs) in the United States, or how the creation of clearer regulations might attract trillions of dollars from institutional investors. Even though more sophisticated financial products will likely assist in the wider adoption of Bitcoin and increase prices, actions taken by financial actors have not been particularly associated with the prospect of hyperbitcoinization.

However, El Salvador President Nayib Bukele's announcement to issue a Bitcoin bond, at the end of Bitcoin week in El Salvador, once again caught many observers by surprise. The Bitcoin bond — also called the Volcano bond — is a $1 billion tokenized bond that will be used to finance the construction of the first Bitcoin city and infrastructure in the Central American country. The Bitcoin bond offers several disruptions in comparison with traditional bond markets:

- The Bitcoin bond has the power to circumvent several layers of intermediaries, thereby allowing El Salvador to reduce its capital costs and interest payments thanks to low, 6.5% coupons.

- Out of $1 billion, $500 million will go into infrastructure and $500 million will be invested in buying bitcoin.

- The first version of the bond will be available in the first quarter or 2022 on Bitfinex under the EBB1 ticker symbol, and if successful, we can expect other bonds to follow.

The long-term reverberations for El Salvador are promising. Not only does this initiative provide for the construction of the geothermal energy infrastructure needed to power an entire new city, but it could also create a surplus of green energy that could be exported to neighboring countries. Most importantly, the Bitcoin strategy designed by the El Salvadoran government could attract the kind of global investment and knowledge workers that would help establish long-term prosperity in the region. By showing the rest of the world its openness to business and capital influx, El Salvador could replicate the success of the Asian Tigers in the 1960s.

The Bitcoin Community

The growth of the Bitcoin network is based in a strong community committed to the idea of a P2P electronic cash system. Orphaned since the disappearance of its creator Satoshi Nakamoto, the Bitcoin ecosystem continues to play a major role in spreading his ideas. By supporting technological developments and their diffusion, the Bitcoin community undergirds the process of technological familiarization within the public and private spheres addressed in this series of articles.

This motley international community of enthusiasts nicknamed “cyber hornets” encompasses miners, node holders, investors, speculators, analysts, entrepreneurs, journalists, influencers, OSS contributors and developers who devote considerable time and energy to educate new users and contribute, defend and support Bitcoin.

The actors described in the following section are representative of this community of cyber hornets, and contribute to the global dissemination of Bitcoin technologies.

Influencers

Influencers represent a group of thinkers, investors and entrepreneurs who have significant media coverage and habitually voice their opinions on Bitcoin. Bitcoin detractors regularly criticize the technology on both social and traditional media to discredit influencers. Others, like Michael Saylor and Jack Dorsey, who understood the impact Bitcoin will have on their companies, frequently praise its invention and are joined in their praise by global business leaders. It may be difficult to quantify the long-term effects that influencers have on uptake of Bitcoin technologies, but debates around these new technologies help normalize them in the eyes and ears of the wider public.

In the short term, however, this kind of promotion may also negatively impact public perceptions, as we saw in the wake of Elon Musk’s inconsistent social media messaging. Following a series of tweets where the tech entrepreneur targeted the energy consumption patterns of proof of work, the price of the asset experienced strong variations (figure five).

NGU Technology Fans

“Number go up” or “NGU,” is by far one of the most influential explanatory factors in Bitcoin adoption. In this scenario, newcomers drive the price of bitcoin up, while the increasing asset price attracts a new wave of investors, HODLers and the curious. As shown in figure six, continuous price increases from inception onwards produces “fear of missing out,” (FOMO) that is, a fear of not being included in something that others are experiencing.

“NGU technology” acts as an efficient, clear and self-sustaining marketing message. In figure six, the evolution of the number of crypto wallet app downloads coincides with the 2018 and 2020 bull markets and there is no reason to believe this relationship will change in future.

Most hyperbitcoinization scenarios are based on the mass adoption of Bitcoin by several types of players — individuals, businesses, cities and eventually countries — in a sequential way, with this mass adoption ultimately driving up the price of bitcoin.

The NGU technology narrative is supported by several price models based either on fixed production, in the case of “S2F” and “Lengthening Cycles And Diminishing Returns,” or based on energy consumption, in the case of “Bitcoin Energy Value.'' Alternatively, actors such as Mimesis Capital propose an approach that consists of evaluating the asset price relative to the possible total market share that could be captured as shown in the M2 money and global wealth examples (figure seven).

All of these models may have an effect on public perception by suggesting a future price increase and by reinforcing the message of NGU technology.

Anonymous Educators

Since the early years of Bitcoin, individuals initiating friends and family into the cryptocurrency world have been a key part of Bitcoin culture. Word of mouth led people to discover this open, decentralized, borderless and censorship-resistant currency. Over time, personal accounts have continued to grow as more structured initiatives have appeared alongside to evangelize those with inquiring minds.

The Bitcoin Beach community in El Salvador is one of the more prominent examples of this process. Although the community remained under the radar for some time, it was instrumental in El Salvador’s decision to adopt bitcoin as legal tender, thereby positioning the country at the forefront of financial innovation.

Inspired by Bitcoin Beach, other initiatives have tried to replicate its enthusiasm in other communities. In Senegal, Bitcoin Developers Academy is aiming to train university students in the development of Bitcoin and Lightning Network applications by adapting the content and values of other Bitcoiners.

The notion of adaptation is crucial. The Bitcoin narrative is shaped by individuals imbued with predominantly Western values and for whom notions of individual freedom, privacy and self-sovereignty resonate. In many societies, money is seen as a mechanism for strengthening social relations within the group. In order to onboard new segments of the populations of Africa or Latin America, it is vital that the Bitcoin narrative be adapted to resonate with locals. Narratives centered around Bitcoin as a tool of individual freedom or means of privacy protection have done little to inspire imaginations in Eastern Africa. Instead, newcomers have grafted an alternative set of values onto Bitcoin that connect with the sense of community belonging encapsulated by the concept of Ubuntu, which is often translated as, “I am because we are.”

If new users embrace the technology, their expectations will differ from those held by earlier adopters, and in response, the Bitcoin narrative, functionality and services will necessarily evolve. By introducing multisig shared custody in its Bitcoin beach wallet, Galoy gives another example of a necessary adjustment of the narrative in Central America, describing it as:

“...a multi signature solution where the keys for the funds in cold storage are held by established members of the local community. This model reduces reliance on centralized companies outside of the community while also reducing friction of onboarding members to the network.”

Adaptation of functions and educational content conveyed by Bitcoin in response to uptake in new cultural contexts will be a source of significant innovation and enrichment for the community as a whole.

Perspectives

Bitcoin As A Feedback Loop

Learning about Bitcoin is often a personal, intrinsically-motivated journey that encourages inquiry into a range of subjects as varied as the monetary system, technology, economy and philosophy. In this sense, Bitcoin plays the role of a virtual tutor who cultivates a thirst for knowledge in its followers. Once convinced of the superiority of Bitcoin over alternative currencies, individuals develop behaviors that reflect the nature of this invention.

The limited supply of Bitcoin has encouraged hoarding behaviors from several types of actors. Prior to 2016, bitcoin traded below $1,000 and therefore acquiring multiple coins was considered an attainable goal for many people in the developed world.

Fast forward to 2021, when the price of bitcoin has appreciated considerably, such that it has become onerous for newcomers to acquire an entire bitcoin. The result is that newcomers are incentivized to buy smaller fractions of bitcoin. The accumulation of satoshis or “stacking sats” is the most concrete example of this practice that has pushed an entire generation of newcomers to acquire bitcoin in a programmatic and methodical way, as demonstrated by the success of companies proposing DCA services or cashback rewards.

One of the consequences of newcomers’ propensity to maximize the share of bitcoin in their asset portfolios — and hence, savings — is that if enough newcomers share this strategy, their cumulative efforts could propel the price of bitcoin significantly higher and eventually kick-off hyperbitcoinization.

For each new daily expense, Bitcoiners are faced with a choice of whether or not to spend. By spending, they deprive themselves of the possibility of buying more Bitcoins, while if they refrain from spending the money saved can be converted into satoshis. This behavior clearly indicates a preference for future reward over immediate superficial spending. In this way, Bitcoin has transformed people from consumers into savers and can be seen as a reference of value anchored in the mind of consumers in a way that supports prudence.

By privileging the essential over the superficial, the durable over the fragile, and the fruitful over the futile, Bitcoin stands poised to help our society respond to the economic, environmental and social crises we are facing. For the first time, the introduction of a currency whose existence is linked directly to a conversion of energy will allow us to systematically integrate energy not only into our currency, but into our economic model.

This sends a strong signal given that Bitcoin is a social movement under expansion. By being the first to incorporate energy into the economic system, Bitcoin could act as a feedback loop that puts an end to the superficial consumerist models permitted and sustained by fiat monetary systems.

Shot For Prosperity

Large-scale Bitcoin adoption may seem like a remote possibility for some, but it has nevertheless become a full-fledged financial tool for an eclectic crowd. The West tends to view the countries from the global South as lagging in terms of the latest technological innovations, but following a series of interviews, the authors of this article have come to believe that where Bitcoin is concerned, the level of technological sophistication surpasses that found in many developed countries.

In the table above, case one depicts how Bitcoin adoption by low-income families resolves challenges that may be difficult for Western readers to understand. Yusuf Nessary, co-founder of the Built With Bitcoin Foundation, recalls that such families — at times isolated from major urban centers — must travel long distances to receive cash-based remittances sent by family members. Traveling to the nearest town not only incurs significant expense, but it also means forgoing a day’s wages for families who live day to day. The introduction of digital payment directly to a cell phone can dramatically improve users’ lives by eliminating the costs of traveling to the nearest bank or ATM.

Cases two and three depict scenarios where individuals and businesses have embraced Bitcoin as a payment method in order to sell their products or services more smoothly and connect to the global economy (#paymeinbitcoin). In an interview with these authors, Bitcoin developer Fodé Diop anticipated that if the digital workforce in Senegal starts selling their services to foreign companies, capital injected into the country will reap benefits not only at the individual level, but also country-wide.

This analysis was shared by Nigerian Bitnob CEO Bernard Parah, who considers that bringing a viable payment solution in Nigeria would solve 50% of the problem and could ultimately help flatten the world, as he said in his own interview with these authors. Diop likewise predicts that Bitcoin could disrupt or even put an end to the brain drain that has impacted emerging economies.

In contrast to Europe’s aging society, the populations of African countries are largely composed of youth under 25 years of age and display dynamic demographic growth (figure eight). If these young people continue to face high rates of unemployment and poor future prospects, the social and economic situation could become explosive — especially in countries with the highest proportions of youth.

The cases sketched above underline the potential of trust-minimized money to become an enabler of trades both nationally and internationally, and to help human society scale as it is universally interoperable, cannot be devalued or confiscated, and can bypass the constraints of the legacy, trust-based banking system.

The Freedom Ladder

Bitcoin can be seen as a polymorphic tool that adapts to the needs of each new user. Bitcoin as a privacy tool or means of self-sovereignty has been its predominant narrative, however self-sovereign identity (SSI) is a concept of the global “rich” that stands outside the reach of the 800 million people who do not have access to electricity, telephones or internet connection (figure nine).

It should also be noted that the introduction of Bitcoin alone is not enough to lift the global population out of extreme poverty. Donations and development programs need to be coordinated with local agents of change, like those being carried out by the Built With Bitcoin Foundation.

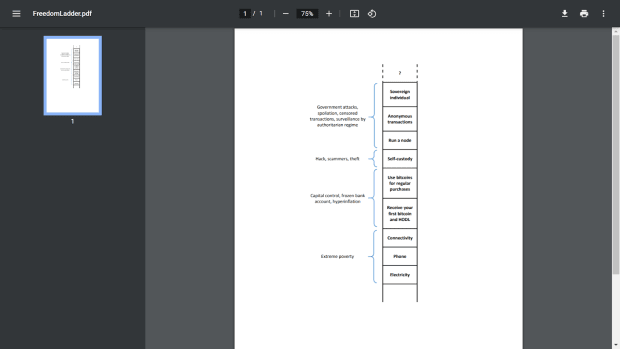

Based on the concept of a “sovereignty staircase” and later elaborated by Anita Posch, below we depict the relationship between the potential threats and living conditions faced by individuals, groups of people and society, with the freedom that stands to be ushered in by Bitcoin. We generalized this concept beyond individual sovereignty because, as mentioned above, this concept still remains abstract to a large part of the population.

This “freedom ladder” illustrates how Bitcoin is poised to bring about a range of solutions that will make it possible to overcome numerous threats on an incremental basis. Although the level of threat faced by an individual living under the oppression of an authoritarian regime or for a group of migrants fleeing an economy ruined by inflation differs, Bitcoin provides solutions for a variety of situations.

The bottom of the ladder includes infrastructural requirements, as these basic needs should be addressed prior to considering access to Bitcoin.

There are extreme situations that may force some populations to jump straight to the highest rungs of the freedom ladder in order to protect themselves from sudden and violent threats. However, for a user or a group of people to understand what self-custody or anonymous transaction involves, it is often necessary to have experienced external threats over a longer period of time, sometimes incrementally, much like a primed immune system that can better withstand being exposed to external attack.

Conclusion

Bitcoin is a unique invention in many ways. Unlike the other great inventions of the modern era such as electricity, the computer or the internet, whose early adoption was initiated by either private companies or public institutions, Bitcoin has always targeted individuals: the marginalized and misfits of the system.

Bitcoin adoption is quiet and goes almost unnoticed by the mainstream agents of influence. Designed to scale by minimizing trust and eliminating dependency on third parties, it is difficult to obtain reliable aggregate data on the extent of Bitcoin adoption by a given country or a segment of the population. The permanent evolution of the protocol — of which Taproot is the latest example — reinforces this privacy and scalability goal and will continue to make attempts for quantitative analysis challenging.

Many questions remain unanswered about hyperbitcoinization and its micro- and macroeconomic consequences. This article attempted to identify emerging scenarios that may lead to hyperbitcoinization. However, it remains difficult to predict how these different scenarios will relate to one another, and at what speed they or any other possible scenarios may occur.

Many challenges remain to be solved before we see a broader adoption and, as Ray Youssef, CEO of Paxful, stated in an interview with these authors, it is crucial to relentlessly educate users, improve their experience and above all adapt the narrative to make Bitcoin more inclusive.

This article sought to identify and categorize initiatives that could lead to hyperbitcoinization, thereby transmuting expectations into reality. Although the mere prospect of hyperbitcoinization has raised immense hopes for many people, at this time we are still far from realizing the transformative power of Bitcoin in our lives.

In view of the dynamism of communities developing islands of resilience across the world, it is not hard to imagine how the voluntary actors of hyperbitcoinization will likely arise from grassroots initiatives, while governments and central banks — through their binding interventions — will unwittingly become its involuntary actors. This hypothesis resonates with the original vision of Bitcoin that it still carries to this day: a P2P electronic cash system.

We would like to express our gratitude to Anita Posch, host of the “Anita Posch Show” podcast; Yusuf Nessary, co-founder and director of the Built With Bitcoin Foundation; Ray Youssef, CEO of Paxful; Fodé Diop, founder at Bitcoin Developers Academy; Bernard Parah, CEO of Bitnob; Gael Sanchez Smith, author of “Bitcoin Lo Cambia Todo”; and Galoy´s team for sharing with us invaluable insights during our interviews; and to Jennifer McCain for reviewing overall readability.

References

- Antonopoulos, Andreas M., and Stephanie Murphy. 2020. “Bitcoin Q&A: Climbing the Sovereignty Staircase [2020].” YouTube. https://www.youtube.com/watch?v=pOVm8YK3A_0.

- Diop, Fodé. 2021. Author interview.

- Dixon, Simon, Max Keiser, and Samson Mow. 2021. “Bitcoin Volcano Bond.” https://www.youtube.com/watch?v=uCRgE4GY1g0&t=7s&ab_channel=SimonDixon.

- Gigi. 2019. 21 Lessons: What I've Learned from Falling Down the Bitcoin Rabbit Hole. Vol. p117. N.p.: Amazon Digital Services LLC - KDP Print US.

- Hayek, F A. 2005. In The: Legacy of Friedrich Von Hayek, 127-129. Vol. 2. N.p.: Liberty Fund.

- McCook, Hass, and Stephan Livera. 2021. “SLP288 Hass McCook – Why You Must Set Up A Bitcoin DCA Plan.” Stephan Livera. https://stephanlivera.com/episode/288/.

- Mimesis Capital and Joe Burnett. 2021. “Valuing Companies Post-Hyperbitcoinization.” https://www.mimesiscapital.com/. https://www.mimesiscapital.com/research/valuing-companies-post-hyperbitcoinization.

- Minting coins. 2017. “#88 Hyperbitcoinization + SEC Meeting, Overstock, Google, & Byzantium Metropolis.” YouTube. https://www.youtube.com/watch?v=PgjmSGjjRvo.

- Nessary, and Youssef. 2021. Authors´ interview.

- Parah, Bernard. 2021. Author interview.

- Posch, Anita. 2020. “Part 4: If Bitcoin Works in Zimbabwe, It Works Everywhere - Bitcoin in Africa: The Ubuntu Way - The Anita Posch Show.” Bitcoin & Co. Podcast. https://bitcoinundco.com/en/africa4/.

- Posch, Anita, and Joshua Scigala. 2021. “#133 Joshua Scigala: Bitcoin and Decentralized Stablecoins.” YouTube. https://www.youtube.com/watch?v=byhZkdQdbME.

- Pysh, Preston, Adam Back, and Samson Mow. 2021. “A Sovereign Bitcoin Bond in El Salvador w/ Adam Back & Samson Mow.” https://www.youtube.com/watch?v=zvJ1kdtTzXw.

- Skogqvist, Jackline Mwende. 2019. “THE EFFECT OF MOBILE MONEY ON SAVINGS BEHAVIORS OF THE FINANCIALLY EXCLUDED.” Södertörn University | Institution of social sciences, (05).

- Suberg, William. 2021. “Netflix 'might' be next Fortune 100 firm to buy Bitcoin — Tim Draper.” Cointelegraph. https://cointelegraph.com/news/netflix-might-be-next-fortune-100-firm-to-buy-bitcoin-tim-draper.

This is a guest post by Fulgur Ventures. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

Read more: https://bitcoinmagazine.com/culture/how-we-reach-hyperbitcoinization

Text source: Bitcoin Magazine: Bitcoin News, Articles, Charts,