Three Arrows Capital (3AC) Liquidators Chase MUCHWOW Yacht, Su Zhu Speaks Out

Three Arrows Capital (3AC), once of the most successful crypto hedge funds in the industry, faces more trouble with the liquidators on their backs. Last week, the court-appointed liquidators Crumpler & Farmer announced that they managed to retrieve $35.6 million in cash assets in several Singaporean banks.

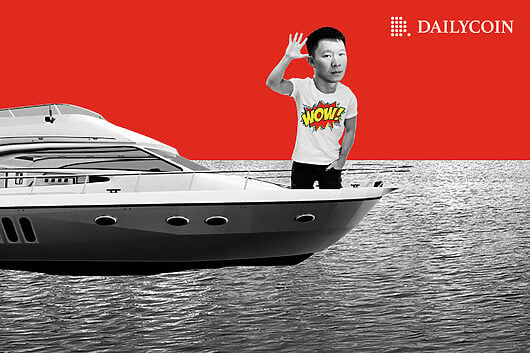

Further on, the liquidation company Teneo disclosed that the next step is to liquidate the famous “MUCHWOW” superyacht, which co-founders Kyle Davies and Su Zhu named after the Dogecoin (DOGE) memecoin. As if that wasn’t enough, today marks exactly a week since the Singapore High Court gave the troubled crypto entrepreneurs an ultimatum.

Wow ??

— FARZAD AHANGI (@FarzadAhangi) December 6, 2022

According to the High Court, both co-founders have to submit affidavits concerning their role in the company’s downfall by 9th December 2022. Interestingly, both infamous co-founders Su Zhu and Kyle Davies emerged on Twitter after months of silence, right after the FTX fiasco.

Three Arrows Capital Puts the Blame on FTX

Kyle Davies and Su Zhu started voicing their opinion on the FTX liquidity crunch and SBF’s unethical methods of business. According to Kyle Davies, FTX liquidated 3AC positions on purpose, aiming to take down the then-flourishing crypto hedge fund.

The hunt for the 3AC head started right after Terra (LUNA) collapsed, according to the YouTube podcast in which Kyle Davies recently appeared.

Further on, Mr. Davies identified that Alameda and FTX were sharing information illegally, gaining an unfair advantage. Ultimately, Kyle Davies claims that 3AC survived the monstrous consequences of Terra (UST) depegging, only to get deliberately taken out of the game by FTX.

Three Arrows Capital: 3AC collapsed due to malicious FTX liquidation the block

— Fortune Crypto (@fortune_btc) December 9, 2022

Meanwhile, Teneo, the company overseeing 3AC’s bankruptcy case, has been complaining to the court about the pair’s unwillingness to engage. Due to evasive tactics, both Su Zhu and Kyle Davies got subpoenaed on Twitter, as the liquidators weren’t able to locate their whereabouts after repeated attempts.

The Perpetual Optimist Strikes Again

The other half of the 3AC duo, Su Zhu, also took to Twitter to bash SBF and FTX. However, Su Zhu also posted a couple of awkward tweets defending the disgraced Terra (LUNA) leader Do Kwon. While calling the attempt to save FTX crypto exchange “the most absurd moral hazard,” Mr. Zhu also answered one inconvenient question: “how come you and Do Kwon came back right after FTX went down, is it just to deflect from your own issues?”

Avoiding the question about himself, Su Zhu shocked some members of Crypto Twitter with his response. He insisted that Do Kwon had been tirelessly working on Luna 2.0 and Terra Luna Classic (LUNC) since the first Terra (LUNA) project failed in May. Self-proclaimed ‘perpetual optimist’ Su Zhu now lives in Dubai, UAE, according to his Twitter bio.

However, the evasive strategy both co-founders of 3AC employ these days suggests that there are still plenty of skeletons in their closet.

Nope

— Zhu Su (@zhusu) December 8, 2022

To have saved FTX would've been the most absurd moral hazard

That an exchange could hunt its own clients, sell their coins, steal their margin, and then at the end of it get a bailout and business as usual -- means the industry should burn down https://t.co/KZZ26qCNU3

On the Flipside

- The fraudulent crypto entrepreneur Sam Bankman-Fried fired back at 3AC’s allegations by saying ‘there’s no evidence’ that Alameda and FTX were working together to crash Terra (LUNA) and double-cross Three Arrows Capital.

Why You Should Care

The now-defunct crypto hedge fund Three Arrows Capital (3AC) owes investors over $3.5 billion in debt. The unfortunate situation set a contagion in the crypto world, putting out of business previously powerful names like Voyager Digital, while the top lender Genesis is trying their best to avoid bankruptcy.

Read the most gripping stories of crypto hacks and scams:

Microsoft Alerts Cryptocurrency Funds of Attacks Perpetrated by the Lazarus Group

FTX Executives, Sam Bankman-Fried, and His Parents Bought Bahamas Real Estate Worth Millions

Read more: https://dailycoin.com/three-arrows-capital-3ac-liquidators-chase-muchwow-yacht-su-zhu-speaks-out/

Text source: DailyCoin.com