Expert Says Big News Coming for XRP as High-Net-Worth BlackRock Clients Are Seeking More Exposure to Crypto

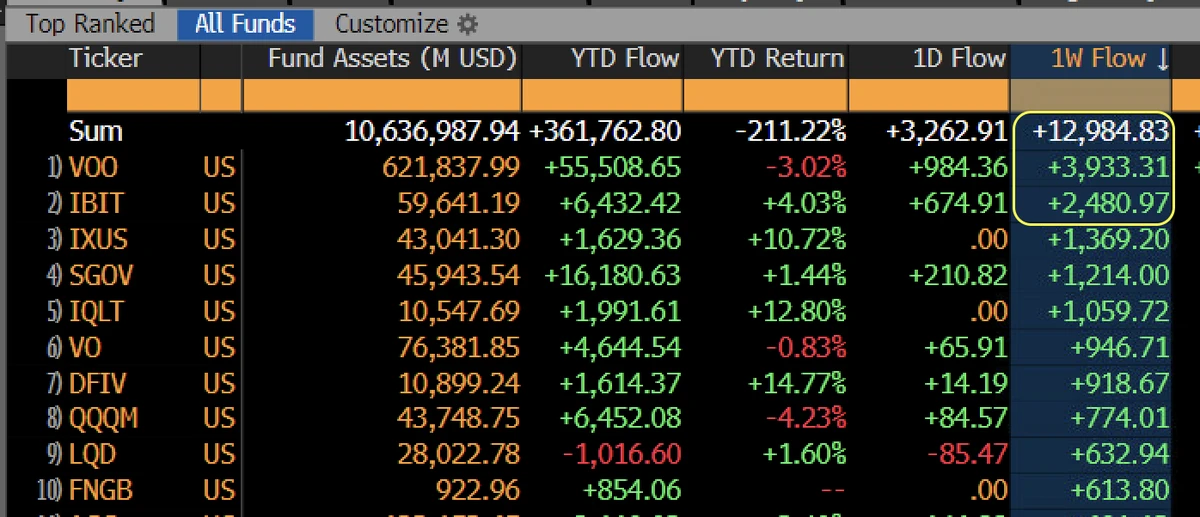

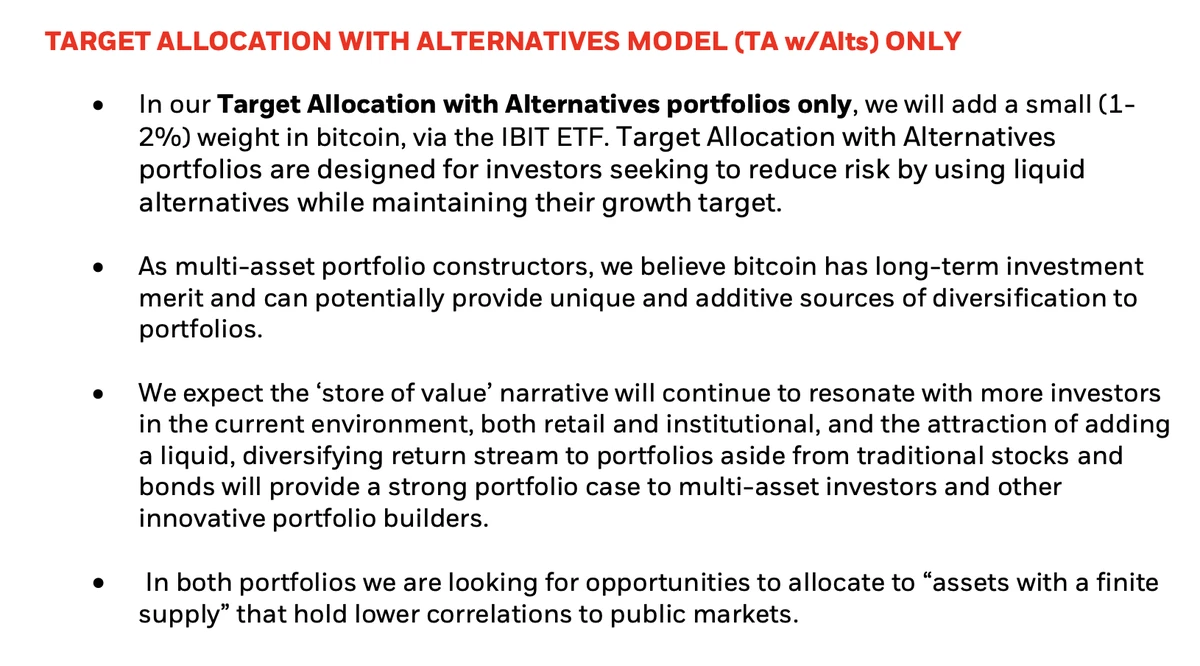

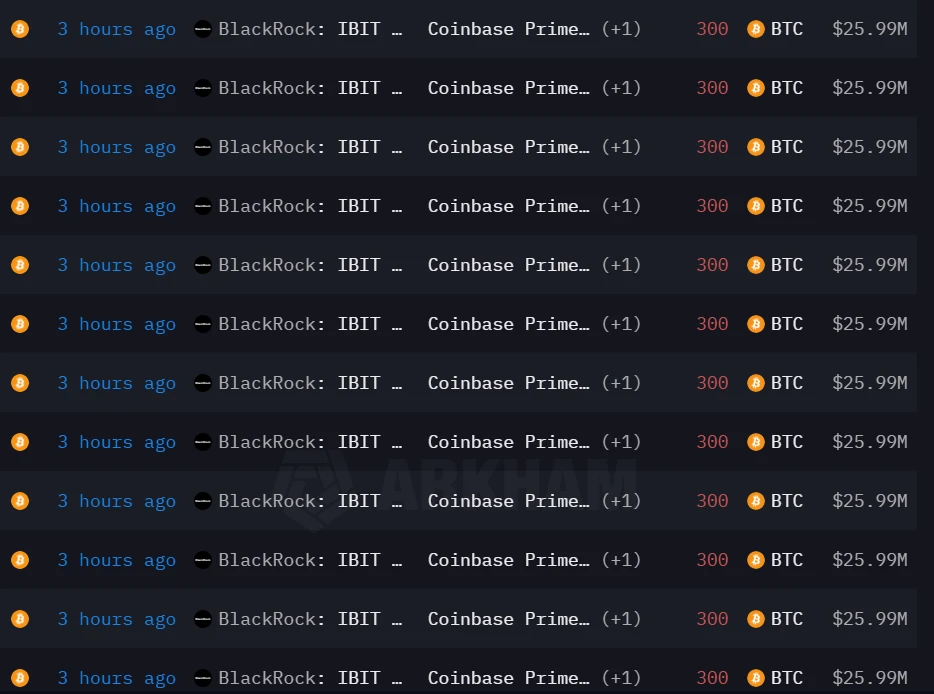

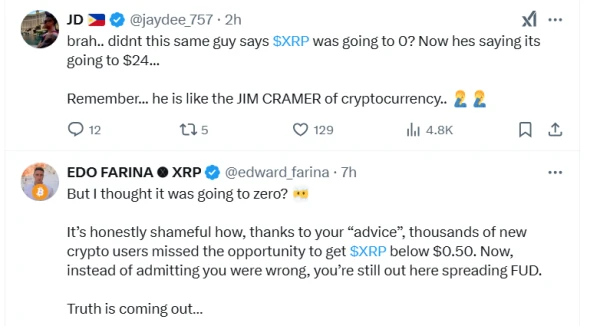

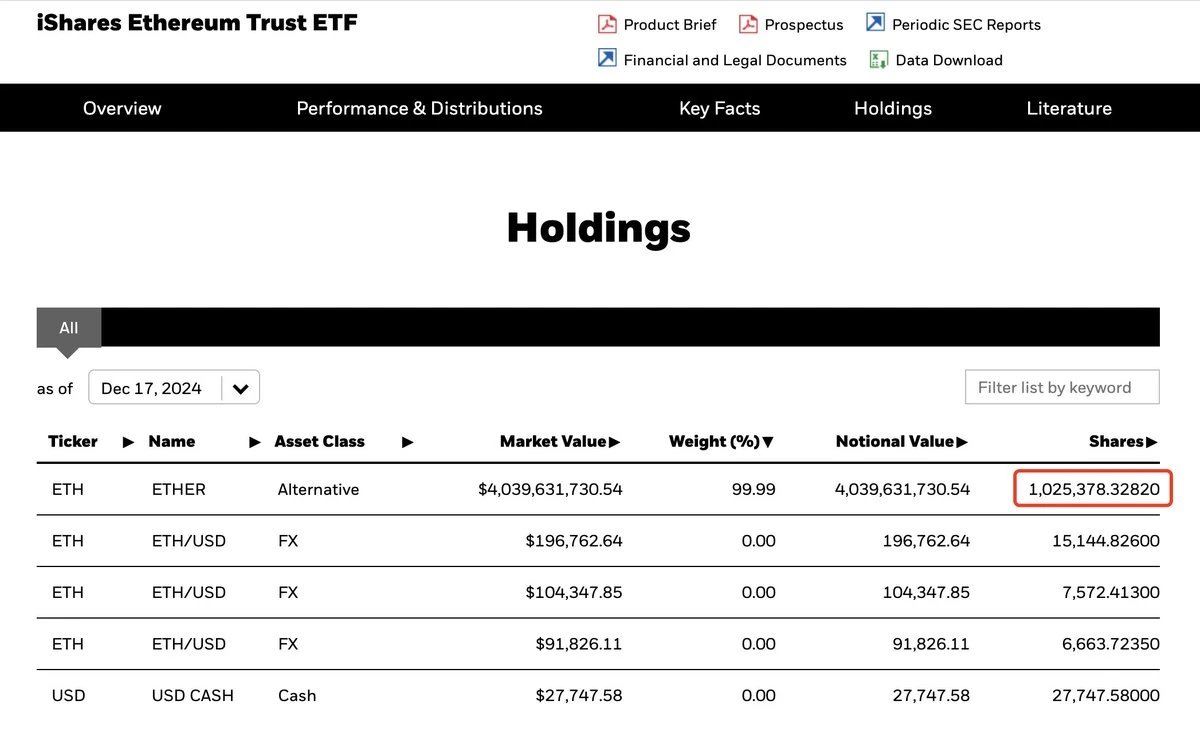

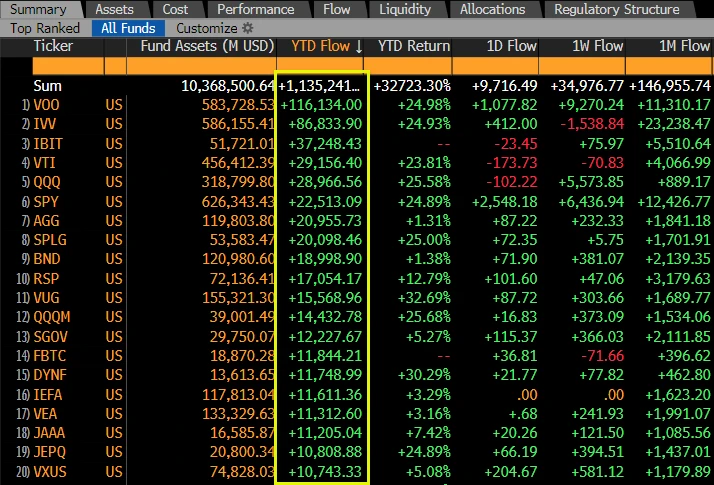

A tweet from widely followed crypto commentator Altcoin Gordon sparked renewed speculation about BlackRock's involvement in XRP.In the post, he claimed to have had lunch with a friend "high up at BlackRock," who revealed growing interest in crypto, particularly XRP, among ultra-wealthy clients.High-Net-Worth BlackRock Clients Seeking More ExposureAccording to the tweet, individuals with a net worth of $50 million and above are increasingly asking about crypto exposure. More notably, Gordon hinted that "some HUGE news" related to XRP could be on the way as a result of this. He promised to issue further updates on the subject in follow-up commentaries.While he failed to provide specific details, his mention of BlackRock has fueled theories ranging from institutional accumulation to potential ETF involvement.Meanwhile, others have pushed back against the claims, disputing them as false. Commentators argue Gordon's claim is merely a "Trust me, bro" source, saying BlackRock's public statements already reflect institutional interest in XRP. They stressed the need to focus on verifiable data, "huge news" discussions.Community reactionCommunity reactionDeep Anticipation for BlackRock XRP NewsNotably, the XRP community has long theorized BlackRock's involvement in XRP, taking cues from various hints and mysterious factors supposedly connecting XRP and BlackRock. They eagerly seek official confirmation, as they believe BlackRock entering the XRP market could change the coin's story.Notably, most significant asset managers listed Bitcoin ETFs have made similar applications for XRP ETFs. Specific names include Grayscale, Franklin Templeton, and Bitwise. Meanwhile, BlackRock's name remains missing in the picture despite other rivals pursuing XRP investment products in the U.S.BlackRock's potential application is highly anticipated due to hopes that its ETF could attract the biggest investments for XRP, as seen with the firms Bitcoin and Ethereum spot ETFs.In perspective, BlackRock's Bitcoin spot ETF has so far seen investments of $44.25 billion, while Franklin Templeton's has seen only $250 million after over one year of trading. Likewise, BlackRock's Ethereum spot ETF has seen $4.2 billion since its inception, while Franklin Templeton's has only $36.5 million.Given this landslide gap, some believe the only ETF that would truly matter for XRP is BlackRock's. Interestingly, industry commentators like ETFStore President Nate Geraci have suggested that BlackRock will eventually join the race. According to him, the firm would fight to dominate the XRP ETF space, not giving rivals a chance.Regarding when this could happen, some suggest it may occur when the SEC and Ripple reach a full settlement in their case. Right now, both parties are negotiating the terms.