David Sacks Says Stablecoin Bill Could Generate Trillions in Demand for US Treasuries

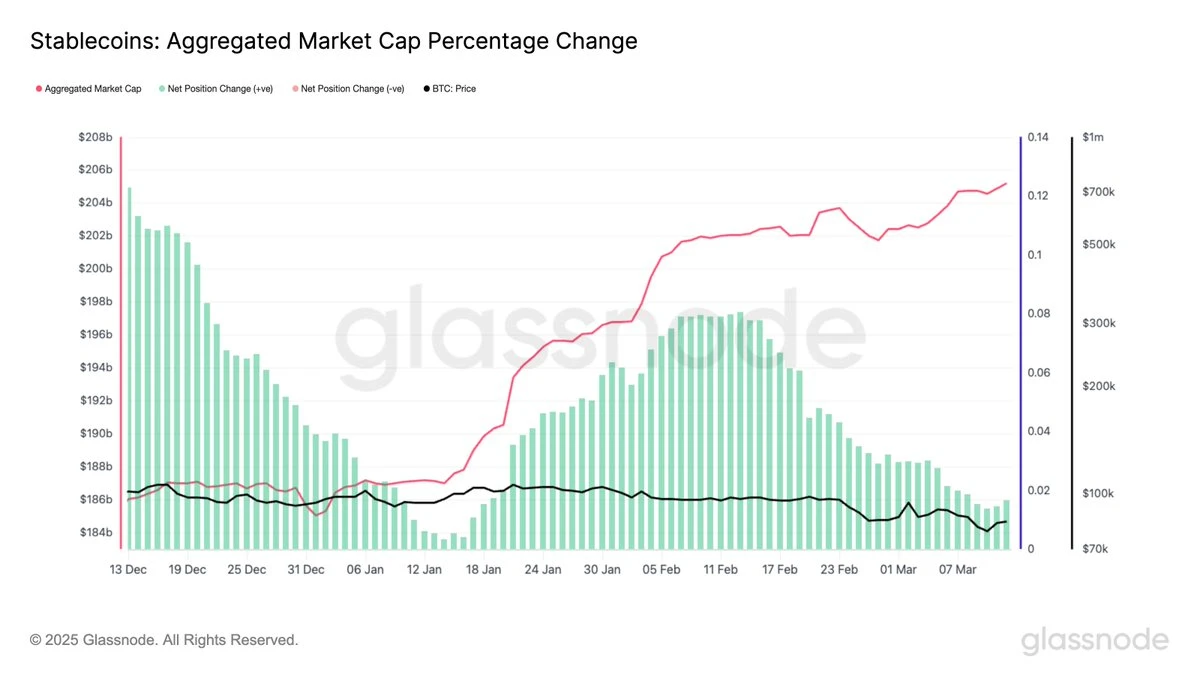

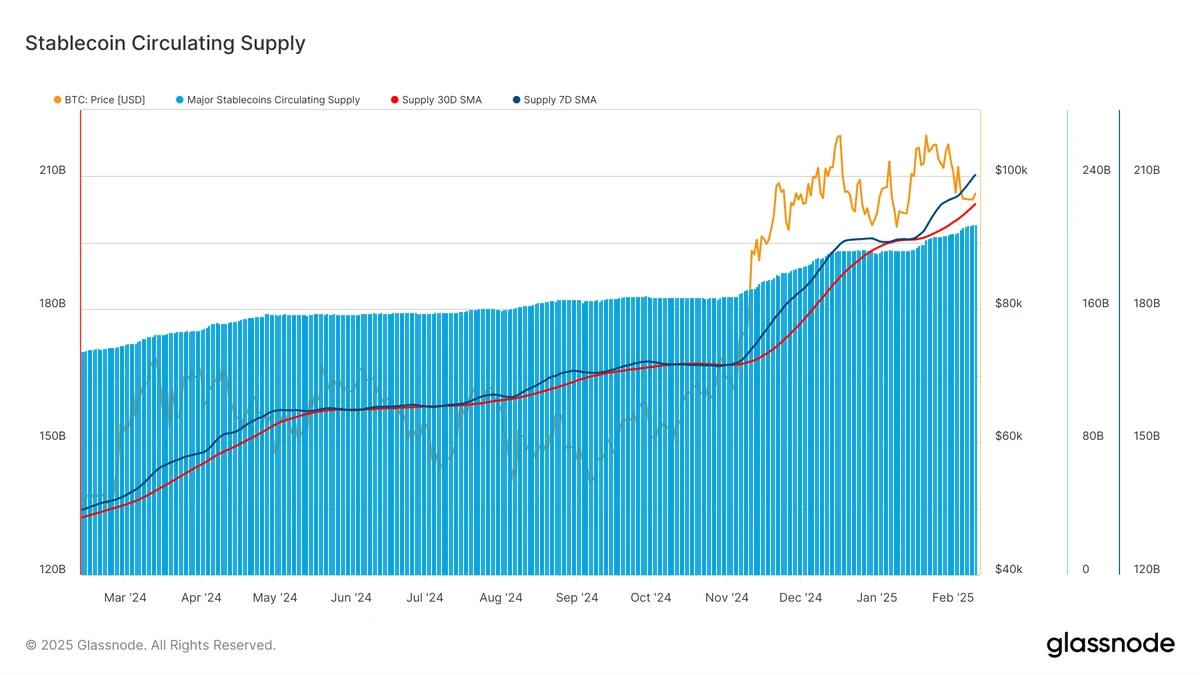

White House crypto advisor David Sacks says the U.S. could see a surge in demand for Treasuries "practically overnight" if the GENIUS Act stablecoin bill is passed.Specifically, he claimed the move could generate trillions of dollars in demand for U.S. government debt.From $200B to Multi-Trillion-Dollar MarketIn an interview on CNBC, Sacks emphasized that the current $250 billion stablecoin market is largely unregulated. He argued that once a legal structure is in place, the market could expand to the multi-trillion-dollar level, driven by global demand for dollar-backed digital assets fully collateralized by U.S. Treasuries.Notably, the GENIUS Act would require stablecoins to be fully backed by U.S. Treasuries or equivalent cash assets. It would also introduce anti-money laundering (AML) compliance standards and impose registration and auditing requirements for issuers exceeding $50 billion in market cap. At the moment, only Tether and Circle meet this rule.Sacks prediction is already partly due to market behavior. Tether, the largest stablecoin issuer, disclosed on May 1 that it holds nearly $120 billion in U.S. Treasury securities. Interestingly, this figure places it ahead of countries like the UAE and Germany among the largest holders of the government asset, according to U.S. Treasury data.This shows that even in the absence of regulation, stablecoin issuers are turning to U.S. Treasuries as a trusted reserve asset, a trend that could accelerate if the bill passes.Bitwise CIO Matt Hougan echoed Sacks optimism, stating that the bill could kick off a multi-year bull run in crypto markets. He projects the stablecoin sector could reach $2.5 trillion in no time, driven by institutional adoption and legal certainty.Meanwhile, other prominent commentators like Senator Bill Hagerty have an even bolder perspective. Hagerty asserted that stablecoin issuers could even emerge to be the largest holders of U.S. Treasuries.Senate Momentum on Stablecoin BillNotably, the stablecoin bill is gaining bipartisan momentum. The Senate voted 6632 to advance the legislation earlier this week, with 15 Democrats joining Republicans. The vote clears the path for a final vote, barring further amendments.Despite bipartisan support, the bill faces criticism from most Democratic lawmakers. Senators Elizabeth Warren and Richard Blumenthal have voiced concerns over potential conflicts of interest.Particularly, their concerns have been around World Liberty Financials USD1 stablecoin, which has ties to the Trump family.Blumenthal warned that the bill, if unchecked, could allow foreign entities to exploit U.S. financial infrastructure under the guise of decentralization. Warren criticized the legislation for not including stronger guardrails to prevent political entanglements.Meanwhile, Sacks declined to address the Trump family's concerns directly but emphasized that the bill would help maintain U.S. dollar dominance and modernize the countrys payment rails.