Jun 21, 2024 12:05

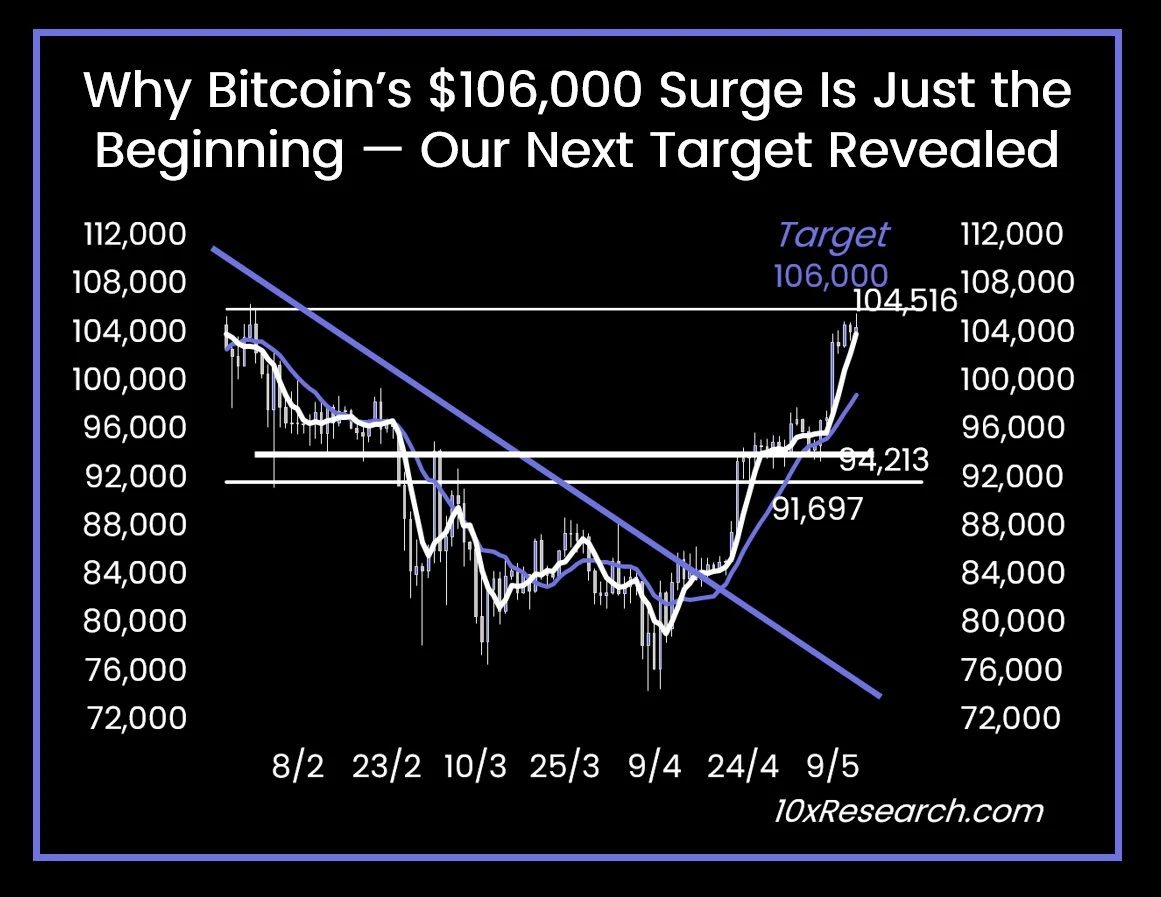

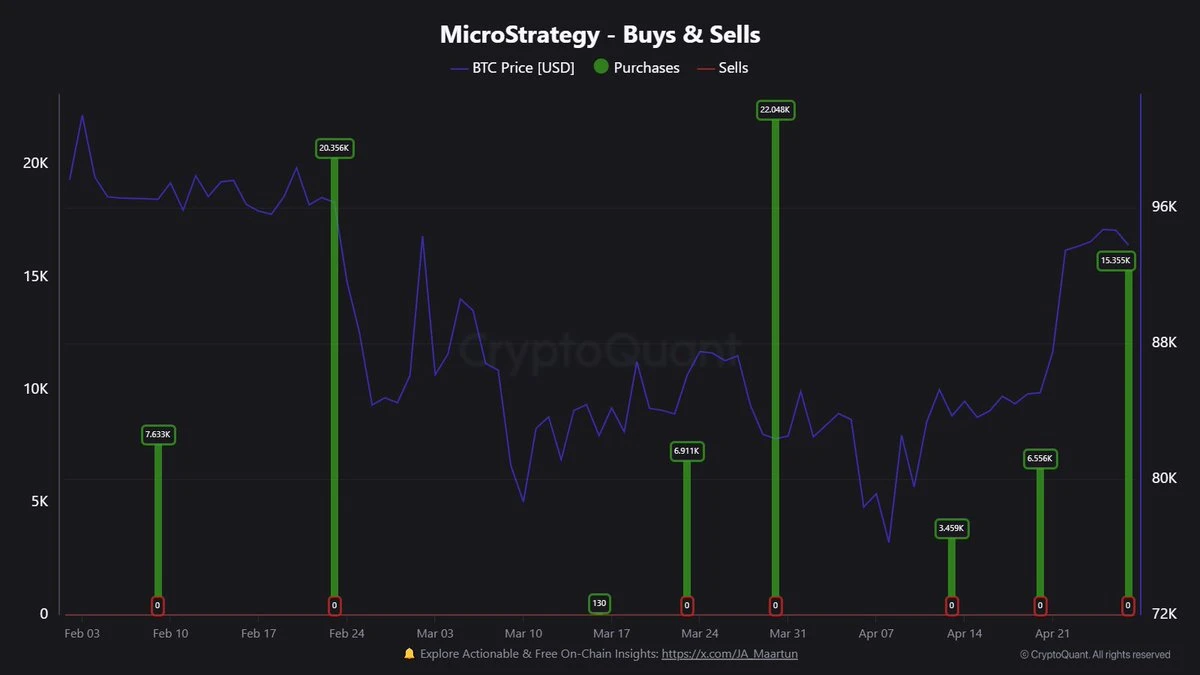

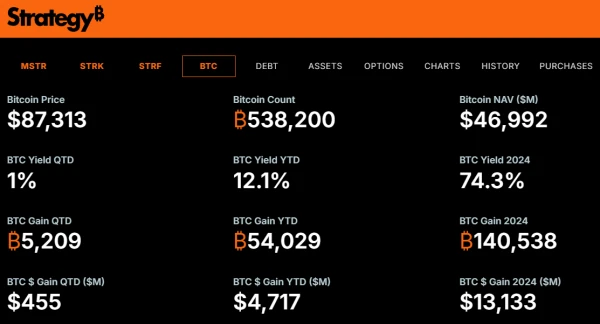

Bitcoin (BTC), the leading cryptocurrency, has regained momentum, bouncing off a weekly low of $64,000 to find support above $65,000, halting last week’s downtrend. This price recovery may be due to another significant investment round by business intelligence company MicroStrategy, led by Bitcoin bull Michael Saylor. The company announced on Thursday the acquisition of an additional 11,931 BTC valued at approximately $786.0 million, further solidifying its position as a major institutional holder of the digital asset. MicroStrategy’s Bitcoin Holdings Surge To Nearly $15 Billion MicroStrategy’s Chairman and Co-founder, Michael Saylor, revealed the latest acquisition in a social media post. The company purchased 11,931 Bitcoin between April 27 and June 19, utilizing proceeds from convertible notes and excess cash at an average price of $65,883 per Bitcoin. Notably, the recent purchases increased MicroStrategy’s overall Bitcoin holdings to an impressive 226,331 BTC, acquired at a total cost of $8.3 billion, currently valued at approximately $14.9 billion. Related Reading: Solana Could Face A 41% Crash, Warns Mechanism Capital Co-Founder Saylor’s interest in Bitcoin dates back to 2020, when he began purchasing the cryptocurrency as a hedge against inflation and an alternative to holding cash. Since then, Bitcoin has experienced substantial growth, appreciating around 600% since Saylor’s initial investments. The recent purchase by MicroStrategy comes at a time when market sentiment towards Bitcoin is mixed. Market intelligence platform Santiment reports that the community is “mainly fearful” or disinterested as Bitcoin’s price hovers between $64,000 and $65,000. However, Santiment suggests that BTC trader fatigue, combined with whale accumulation exemplified by MicroStrategy’s latest acquisition, often leads to price bounces that reward the patient, as seen in the image above. BTCs Cycle Top To Reach New Heights Despite the current mixed sentiment in the market, most experts and analysts are forecasting a cycle top for Bitcoin beyond the current all-time highs. Market analyst Crypto Con recently used Fibonacci retracements to forecast conservative and less conservative potential cycle top targets. According to Crypto Cons analysis, the .618 Fibonacci retracement level has proven reliable for previous Bitcoin cycle tops. Extension levels can be derived by retracing from the cycle bottom to the top of the first move. The cycle tops of 2013 and 2017 were predicted at 4.618, while the 2021 top was forecasted at the 5.618 level. For the current cycle, the conservative target for the cycle top is $106,000, while the less conservative target stands at $161,000, according to Crypto Con. Related Reading: SEC Drama Fuels XRP Rally: Open Interest Skyrockets Adding to the positive sentiment, wealth management firm Bernstein has made bold predictions for Bitcoin’s future price trajectory. Despite arguments from bears that the Bitcoin ETF trade is over and early allocations were driven by retail investors, Bernstein holds a different viewpoint. The firm emphasizes that Bitcoin ETFs are on the verge of approvals at major wirehouses and large private bank platforms in this year’s third or fourth quarter. These potential approvals and institutional interest act as a catalyst for adoption. Bernstein expects Bitcoin to reach a cycle high of approximately $200,000 by 2025, $500,000 by 2029, and an impressive $1 million by 2033. The firm asserts that institutional investors are evaluating “net long” positions, indicating a growing interest in the cryptocurrency. At the time of writing, BTC has limited its losses in the 7-day time frame to 3.6%, resulting in a current trading price of $65,170 for the largest cryptocurrency on the market. Featured image from DALL-E, chart from TradingView.com