Bitcoin Set to Explode After Golds Rally: Heres When It Could Break All-Time Highs

The long-standing correlation between the two assets is drawing fresh attention as both Bitcoin and gold emerge as investor favorites amid growing economic uncertainty.

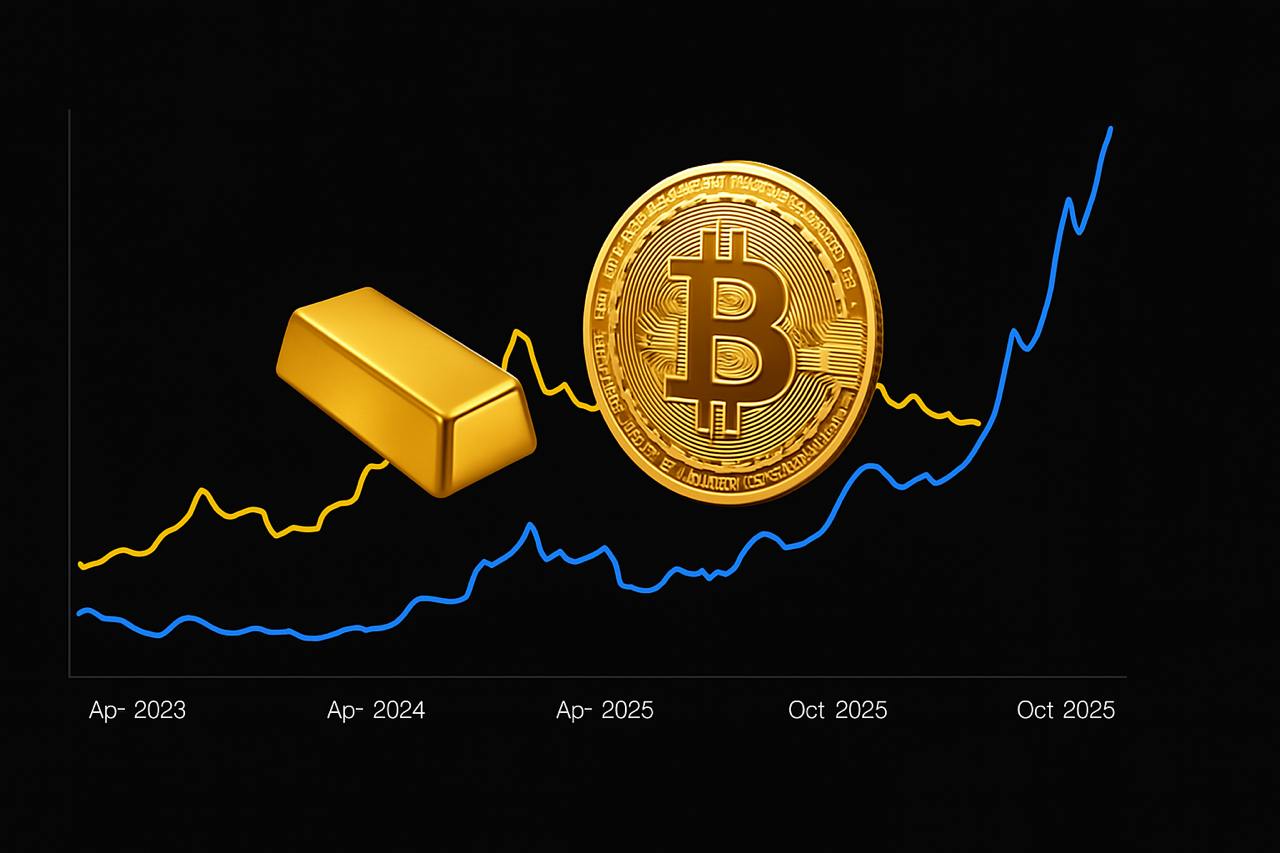

When the printer roars to life, gold sniffs it out first, then Bitcoin follows harder, Consorti explained, pointing to historical patterns where BTC lags behind golds price action by about 100 to 150 days.

This lag effect has played out in previous cycles, where gold rallies first on inflation and fiat debasement fearsonly for Bitcoin to surge after, often breaking through previous all-time highs.

With gold already hitting new highs in 2024, some analysts believe Bitcoins turn could come in Q3 or Q4 of 2025, especially if macroeconomic conditions worsen and investor demand for US dollar alternatives spikes.

Consortis thesis adds to growing sentiment that Bitcoin is increasingly behaving like digital gold, serving as a hedge against monetary expansion and geopolitical risk.

The correlation between the two assets can be seen clearly in price movement charts shared across platforms like X (formerly Twitter), where traders are watching the lagging trend closely.

As inflation fears simmer and central banks face mounting pressure to stimulate economies, both gold and Bitcoin could once again shine as safe-haven assetswith BTC potentially leading the next leg of the crypto bull run.

The post Bitcoin Set to Explode After Golds Rally: Heres When It Could Break All-Time Highs appeared first on Coindoo.

Text source: Coindoo