Here is How High DOGE Can Rise if It Gets 50% of BTC Inflows, As Grayscale Files for Doge ETF

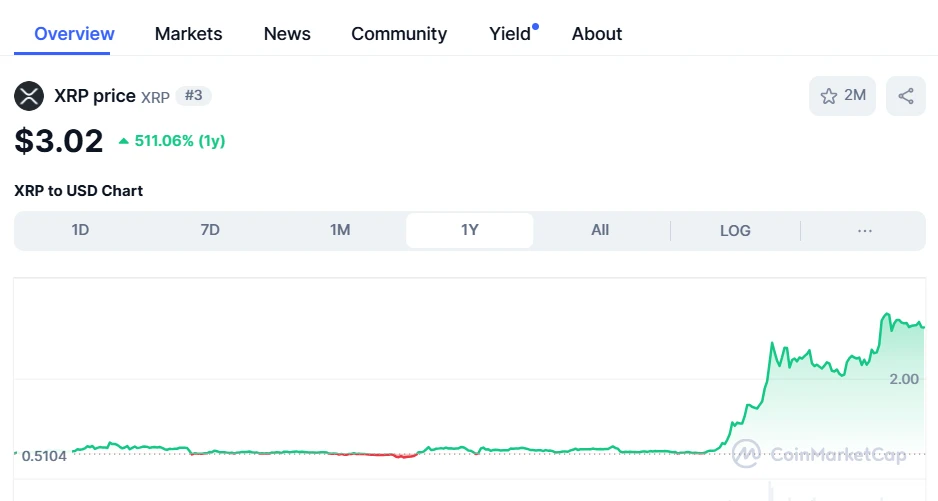

With Grayscale filing for a Dogecoin ETF, the Dogecoin price could skyrocket tremendously if the product captures only 50% of Bitcoin ETF inflows after approval.Grayscale Investments has introduced the Grayscale Dogecoin Trust, looking to provide institutional and accredited investors with exposure to Dogecoin. Following this launch, the firm promptly filed with the U.S. Securities and Exchange Commission (SEC) to convert the trust into a spot exchange-traded fund (ETF). https://twitter.com/JSeyff/status/1885459699186716927The move syncs with Grayscale's push to expand its crypto offerings. Recall that the company made similar moves with Bitcoin and Ethereum, filing to convert its BTC and ETH Trusts to ETFs with the SEC. Interestingly, Grayscale also recently carried out these steps with its XRP Trust.Notably, the Grayscale Dogecoin Trust will track Dogecoin's market price, presenting investors with a regulated avenue to gain exposure to the meme coin without direct ownership. Currently, the trust is available for subscription to eligible accredited investors and will transform to an ETF following the SEC's approval.Dogecoin Price if Its ETFs Attract 50% of Bitcoin ETF InflowsThis filing is one of several efforts from different assets managers to introduce Dogecoin ETFs. Should these products see the light of day, they could attract more institutional capital into the Dogecoin market, impacting DOGE price positively.For context, this trend played out with Bitcoin, with the sustained flows into Bitcoin ETFs pushing the BTC price to a new all-time high before a halving event for the first time ever. Specifically, these Bitcoin ETF products have recorded $40.5 billion in capital inflows since they launched in January 2024.Notably, if Dogecoin ETFs witness only 50% of these inflows, this could have massive implications for prices. Particularly, 50% of the Bitcoin ETF inflows amounts to $20.25 billion. Applying the BoA 118x inflow-to-valuation multiplier leads to an additional market cap of $2.39 trillion for DOGE.Meanwhile, market data confirms that Dogecoin currently boasts a market cap of $47.6 billion. An addition of $2.39 trillion would lead to a total valuation of $2.86 trillion. Now, considering Dogecoin's circulating supply of 147.8 billion, a $2.86 trillion market cap translates to a price of $19.34. This would mark a 5,895% increase from the current price of $0.3226.However, it bears mentioning that there is no guarantee that Dogecoin ETFs would record such a substantial amount of capital. For instance, Ethereum ETFs have only seen $2.76 billion inflows despite existing since July 2024.Dogecoin ETF Race Heating UpNonetheless, the ETF race for Dogecoin appears to be heating up. In a related development, Bitwise also filed an S-1 form with the SEC to establish a Dogecoin ETF. Notably, Wintermute, a prominent crypto market maker, had earlier predicted that a major asset manager would launch a meme coin ETF in 2025, with Dogecoin being the likely candidate. This forecast has now materialized with Grayscale's recent filing.