SEC vs. Ripple Case Finally Ends as SEC Drops Its Appeal

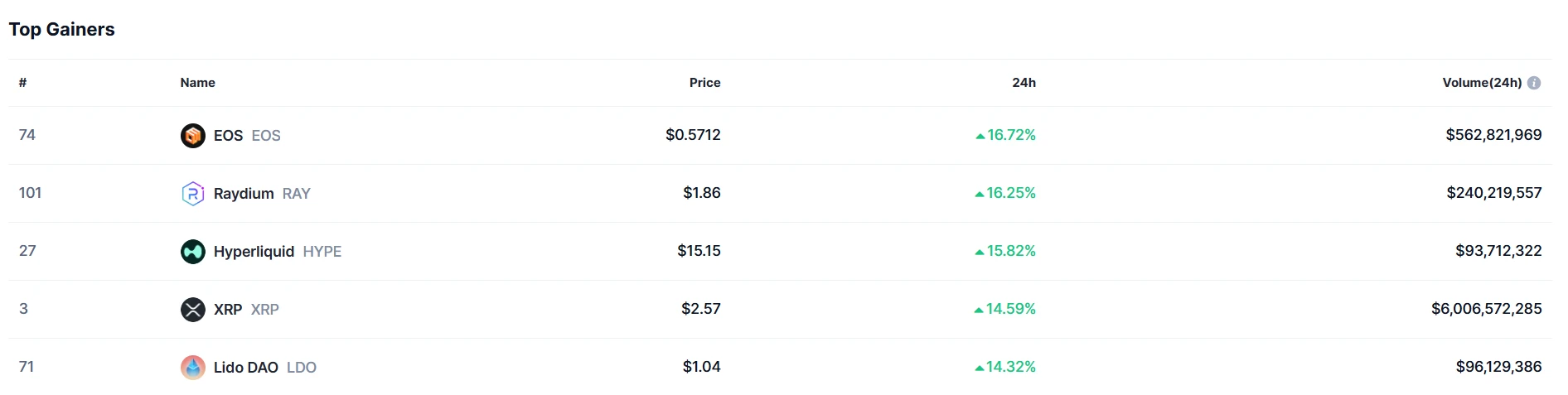

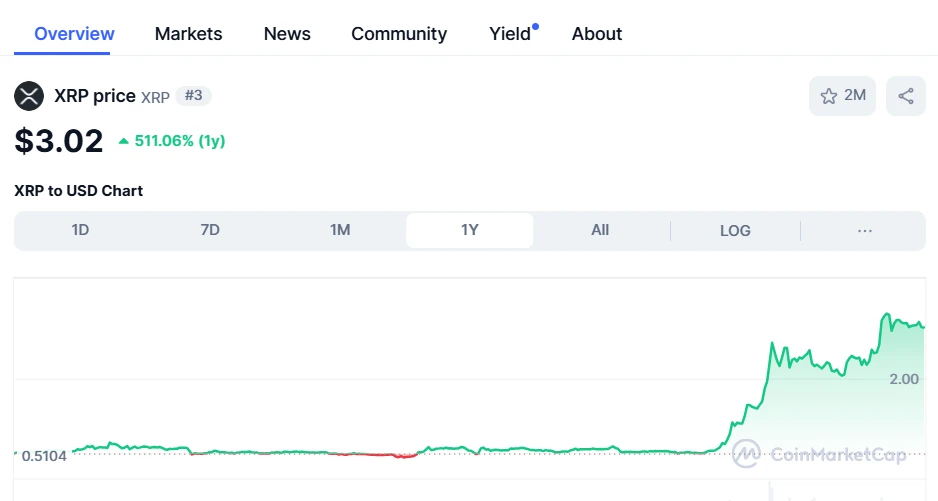

The SEC vs. Ripple legal battle has officially come to an end, as the U.S. SEC drops its appeal.The U.S. Securities and Exchange Commission (SEC) has officially dropped its appeal in its long-running lawsuit against Ripple, marking the end of a four-year legal battle. Ripple CEO Brad Garlinghouse broke the news, calling it a major victory for the company and the entire crypto industry.Ripple CEO Calls It a Long-Overdue SurrenderIn a broadcast message, Garlinghouse stated that from the very beginning, Ripple believed it was on the right side of both the law and history. He argued that the lawsuit was never about protecting investors but was part of a broader attack on the crypto industry.https://twitter.com/thecryptobasic/status/1902348370053632414He described the case as an attempt to intimidate and weaken the industry through legal pressure. According to him, the SEC's actions led to massive financial losses, with the lawsuit wiping out $15 billion in market value. He also accused the agency of trying to manipulate the market rather than seeking justice.Throughout the case, Ripple won several key legal victories. Garlinghouse pointed out that the judge had criticized the SEC multiple times, including rebuking the agency for failing to follow the law. The SEC was also sanctioned for misconduct during the discovery process, further weakening its position.Most importantly, Ripple successfully argued that XRP is not a security, as ruled by Judge Analisa Torres in July 2023. This ruling now sets a legal precedent that could impact future crypto-related cases.What Next?With the SEC dropping its appeal, Ripple is now in control of its next steps. Chief Legal Officer Stuart Alderoty stated that the company will evaluate whether to proceed with its own cross-appeal. https://twitter.com/s_alderoty/status/1902348432913641550The primary issue left unresolved is a $125 million fine and a permanent injunction on Ripple's institutional sales.Attorney Jeremy Hogan outlined four possible outcomes: Ripple could continue its appeal, which might lead to a court ruling clarifying the legal definition of investment contracts. Ripple might drop its appeal, returning the case to the trial court for potential amendments to the judgment. Both parties could settle privately without modifying the ruling and Ripple could drop its appeal. Ripple could simply pay the fine and move on.The End of the "War on Crypto"?Garlinghouse framed the SEC's decision as a sign that the agency's aggressive stance against crypto is coming to an end. Interestingly, before now, the new SEC leadership had also dropped cases and investigations against other crypto firms, including Coinbase, Consensys, OpenSea, and others.The Ripple CEO suggested that forces within the former administration had worked to suppress the industry by restricting access to banking services. He described the lawsuit as "lawfare," a campaign designed to legally terrorize crypto companies into submission.However, he believes that Ripple's victory has set the stage for the industry to fight back. He called on crypto companies to stand together, learn from Ripple's legal playbook, and push for fairer regulations. He also expressed hope that new leadership in the U.S. government would take a more constructive approach to crypto policy. For context, the new Donald Trump administration has taken steps to ensure the regulatory antagonism ends.Following Garlinghouse's disclosure, XRP soared to $2.57, securing a 14.59% gain in the last 24 hours. This placed the token among the top 5 gainers over the past day. However, the uptrend has lost steam at press time, with XRP now trading for $2.5. Analyst Dom had suggested XRP might not pump hard after the case resolves.XRP Among Top 5 Gainers CoinMarketCapXRP Among Top 5 Gainers | CoinMarketCap