14 US States Hold $632M in MicroStrategy Stock as Public Funds Increase Bitcoin Exposure

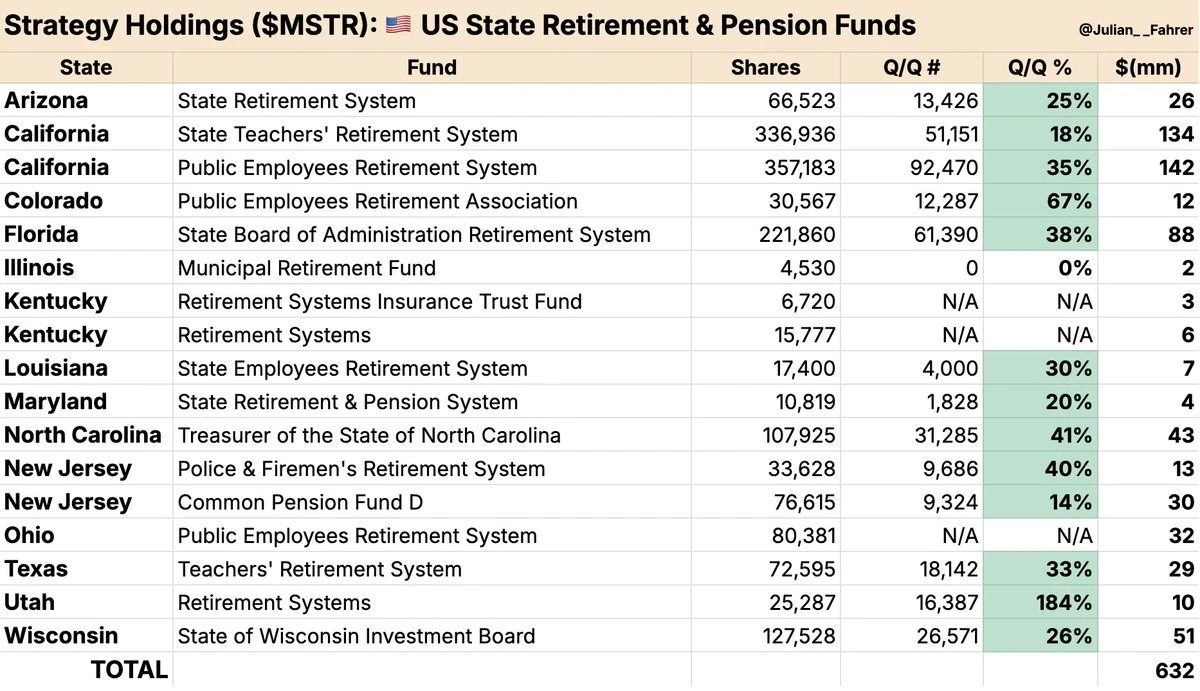

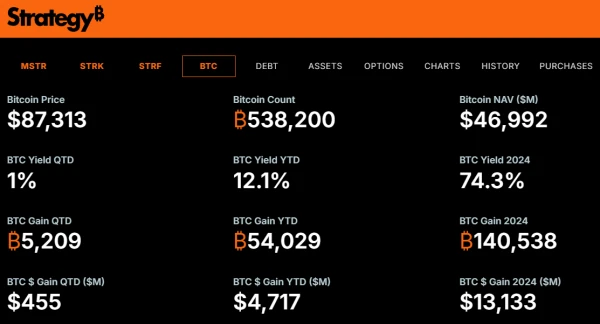

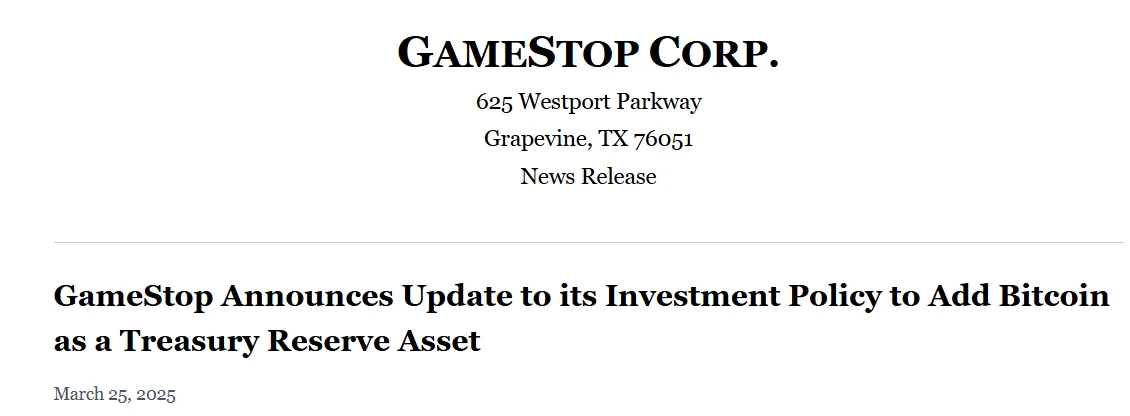

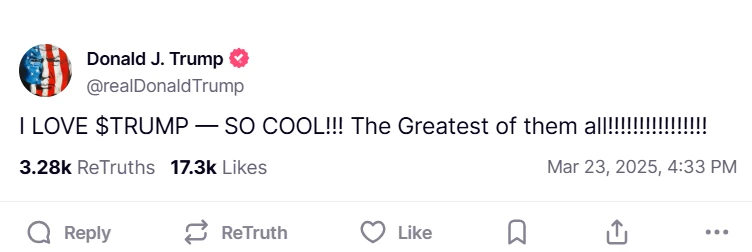

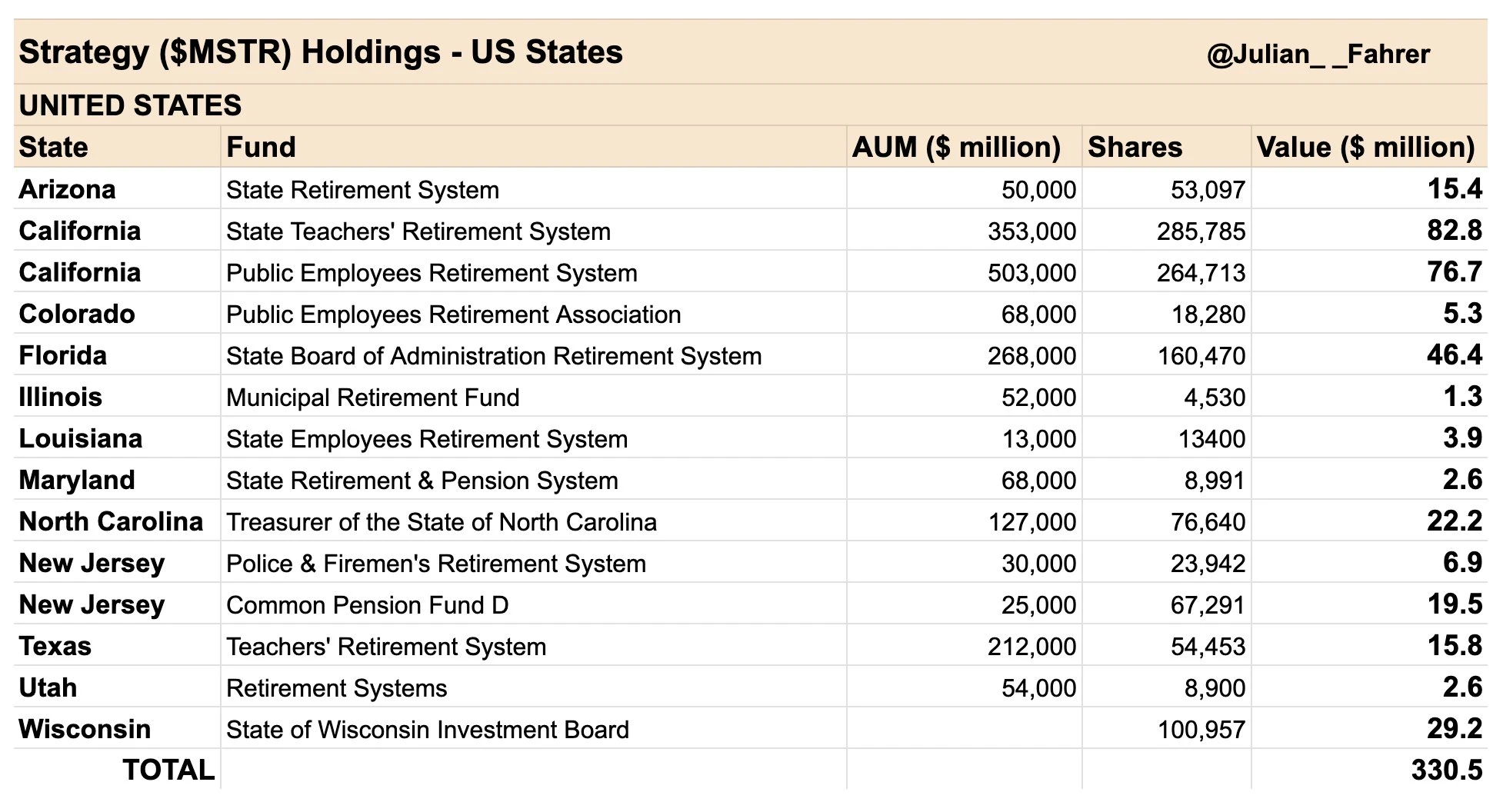

At least 14 U.S. state public retirement and pension funds now collectively hold $632 million in MicroStrategy (MSTR) stock, a company best known for its large Bitcoin treasury.The data, compiled by Julian Fahrer, founder of Bitcoin Laws, highlights a strong quarterly increase of $302 million, underscoring the expanding role of Bitcoin-linked equities in government portfolios.MicroStrategy as a Gateway to BitcoinMicroStrategy (now rebranded as Strategy) has become widely recognized as a proxy for Bitcoin exposure due to its long-term strategy of acquiring and holding BTC on its balance sheet. For public funds seeking indirect exposure to Bitcoin without holding the asset directly, MSTR has emerged as a preferred vehicle.In Q1 2025, the combined investment from these 14 states reflects a growing appetite for Bitcoin-aligned equities. On average, the state funds increased their position size in MSTR by 44% compared to the previous quarter.California, Florida, and Wisconsin Lead the PackCalifornia led the group with the largest total holdings. The State Teachers Retirement System and the Public Employees Retirement System held a combined 694,119 shares, worth over $276 million.Florida followed with 221,860 shares worth approximately $88 million, while Wisconsin held 127,528 shares, totaling $51 million in exposure. Other notable holdings include: North Carolina: 107,925 shares ($43 million) Ohio: 80,381 shares ($32 million) Texas: 72,595 shares ($29 million)Fastest Growing PositionsMeanwhile, Utahs Retirement Systems reported the most aggressive quarterly increase, with holdings surging 184% to 25,287 shares. Colorado also showed notable growth with a 67% jump in shares, followed by Florida (38%), Texas (33%), and Louisiana (30%).Other states that reported an increase in their exposure include Arizona, Maryland, and New Jersey. The overall trend confirms broader acceptance of Bitcoin-aligned investment strategies.`Spreadsheet showing U.S. state exposure to Bitcoin MSTR by Julian FahrerInterestingly, some of these states are pursuing legislation to permit the investment of state funds directly in Bitcoin and strategic BTC reserves. Notably, data from Bitcoin Laws shows that 47 crypto-related bills have been introduced across 26 U.S. states, with 37 currently active.Some, like New Hampshire, have achieved success. Governor Kelly Ayotte signed into law earlier this month a bill permitting up to 5% of the state treasury to be invested in Bitcoin. However, in states like Florida, similar initiatives have failed.Others, like Arizona, are seeing partial success, with support for unclaimed asset applications but rejection of state treasury investment in Bitcoin.Bitcoin Exposure by Proxy Becoming MainstreamDespite the cautious approach still prevalent among many states, this influx of state-managed public funds into MSTR signals a new level of Bitcoin adoption among institutional and government-managed entities.While direct crypto ownership by these entities remains rare, the strategic use of Bitcoin-aligned equities offers a regulatory-compliant and familiar method for gaining exposure.