Apr 10, 2025 12:05

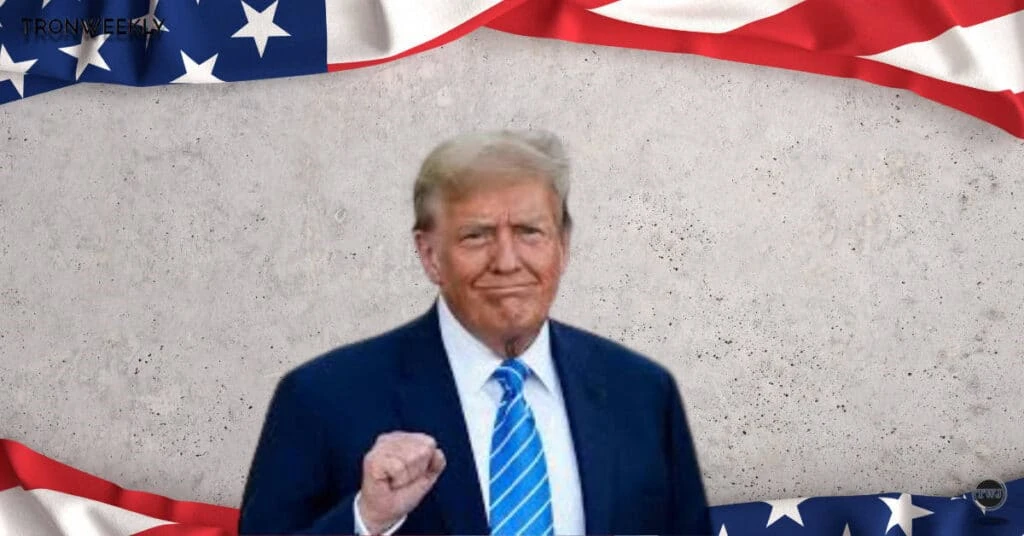

Crypto and stock prices have surged in the past hour after US President Donald Trump announced a 90-day pause for tariffs on multiple nations, except China. Bitcoin (BTC), the flagship crypto, now eyes the $83,000 barrier after jumping 6.1% following the news. Related Reading: Bitcoins Next Big Move? Open Interest Says Get Ready Trump Authorizes 90-Day Pause On Tariffs In a Truth Social post, President Trump announced he was raising China tariffs to 125% effect immediately due to a lack of respect shown to the Worlds markets. This move follows Chinas recently announced reciprocal 84% tariff rate on US goods, starting April 10. Based on the lack of respect that China has shown to the Worlds Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately. At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable, Trump explained. In the Wednesday post, the US President also revealed he had authorized a 90 days PAUSE for other countries, as 75 nations reached out to multiple US Representatives, including the Departments of Commerce, Treasury, and the US Trade Representative, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non-Monetary Tariffs. Additionally, he authorized an immediate substantially lowered Reciprocal Tariff of 10% during the 90-day pause. In a second post, the President stated, This is a great time to buy. Following the news, stock prices surged, with the S&P 500 (SPX) surging around 6% since the announcement. Meanwhile, the crypto market saw its total market capitalization jump around 5%, with assets like Bitcoin, Ethereum (ETH), XRP, and Solana (SOL) increasing 6%-12% in an hour. Bitcoin Price Surges To $82,000 The flagship crypto climbed from the $76,000-$77,000 range to the $82,000, momentarily reclaiming this level for the first time since Sunday. Its 6% surge has sparked optimism among investors, who saw Bitcoin fall to a five-month low over the weekend. BTC dropped nearly 10% between Sunday and Monday, fueled by the ongoing tariff war. Amid the correction, Bitcoin hit the $74,000 support zone for the first time since November. Related Reading: Solana (SOL) Needs 15% Bounce After Multi-Year Support Retest, Recovery Ahead? On Monday, BTC also saw a brief recovery of the $80,000 barrier after major media outlets reported the White House was considering a 90-day pause on tariffs. However, the cryptocurrency erased most gains after the news turned fake. According to online reports, todays surge triggered $75,000,000 worth of Bitcoin shorts being liquidated in the past 60 minutes. As of this writing, Bitcoin trades at $82,444, a 4.1% decline in the weekly timeframe. Featured Image from Unsplash.com, Chart from TradingView.com