Apr 08, 2025 12:05

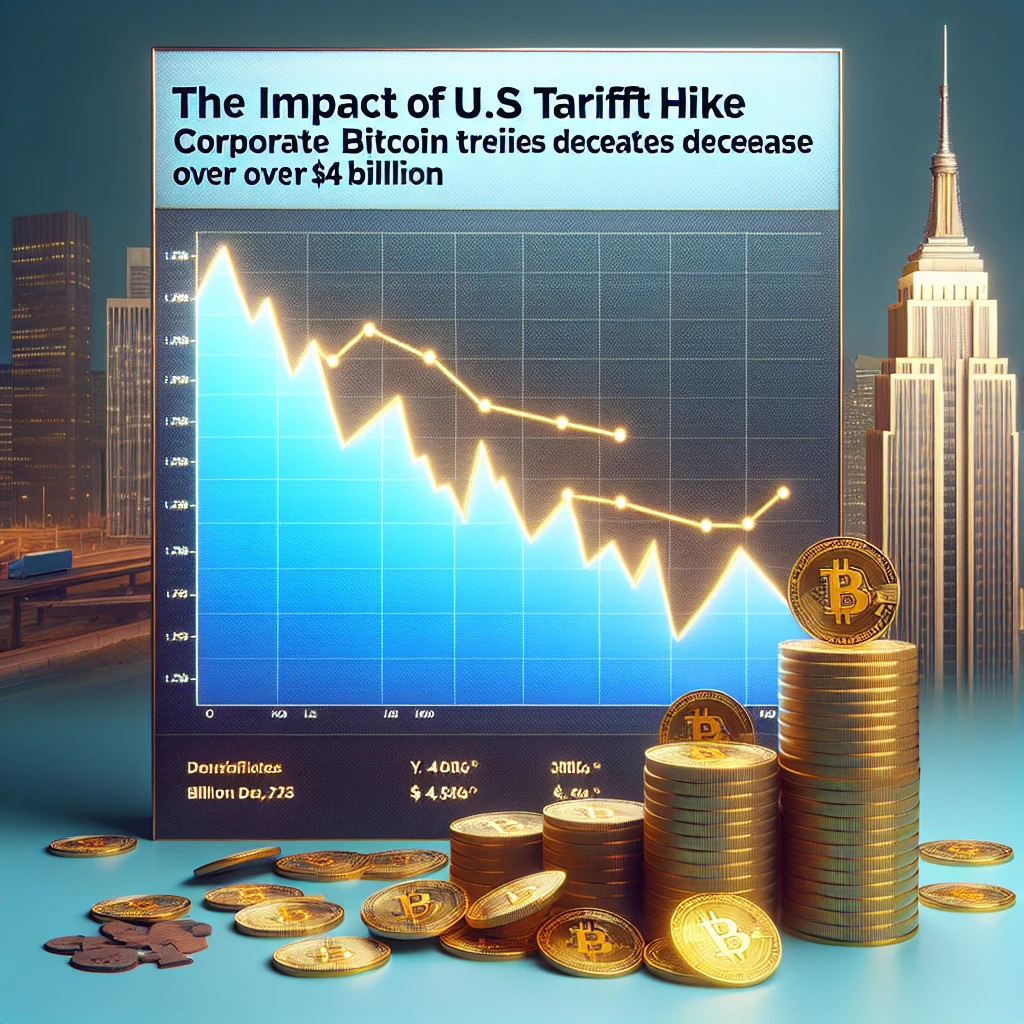

Bitcoin prices fell below $75,000 on Monday, April 7, the lowest since mid-March as investors reacted to US-China trade relations tensions escalating. The digital currency shed about 6% in 24 hours, CoinMarketCap data revealed, as part of a broader sell-off across both crypto and traditional markets. Related Reading: Ethereum Slips Below TriangleIs A $1,600 Crash Next? US-China Trade War Triggers Market Panic The sharp decline comes after US President Donald Trump’s recent imposition of tariff hikes and countermeasures by Beijing. The trade tensions sent shockwaves through world markets, with Wall Street suffering its worst fall since the COVID-19 pandemic. On Friday, April 4, the S&P 500 dropped 6%, the Dow Jones Industrial Average fell 5.5%, and the tech-heavy Nasdaq Composite fell 5.8%. Market commentator Charles Gasparino cautioned on Twitter that “Monday is shaping up to be the ultimate pain day,” and that investors should prepare for further selling pressure as markets open this week. That forecast seems to be coming to fruition as Bitcoin is trading between $74,000 and $75,000, far lower than last week’s levels. Breaking: One major market analyst just told me Monday is shaping up to be the ultimate pain day. Another: Some really nice buys out there particularly in financials. As they say disagreement makes a market! Story developing Charles Gasparino (@CGasparino) April 6, 2025 Ethereum And Altcoins Hit Harder Than Bitcoin As Bitcoin lost heavily, other cryptocurrencies plunged even deeper. Ethereum, which is the second-largest cryptocurrency, by market cap, lost 13% – more than double the percentage drop of Bitcoin. Other well-known altcoins fell hard as well, with SOL and DOGE losing more than 10% in one day. ADA went down by 10.40%, while XRP and BNB lost 7% and 6%, respectively. The worldwide cryptocurrency market capitalization is currently at $2.62 trillion as the majority of top coins fail to find support. Even with the price decline, Bitcoin’s 24-hour trading volume jumped to $26 billion – an 80% rise over the past 24 hours – indicating strong levels of market activity during the sell-off. Investors Turn To Government Crypto Reserves For Potential Relief There is a possible silver lining in market chaos. According to Edul Patel, CEO and co-founder at Mudrex, US government agencies will disclose their crypto assets today. “A huge confirmation could lead to a relief rally,” Patel said. Related Reading: XRP Will ExplodeAnd This Korean Expert Says Hell Be Laughing At Critics Market sentiment remains weak with the Fear and Greed Index inching towards what experts term “Extreme Fear.” This indicator implies that panicked selling has been controlling recent market trends instead of sound investment choice. According to market observers’ reports, Bitcoin now has a crucial technical test. “Bitcoin must retake the $80,000 level or it will retest its prior all-time high around $74,000,” Patel further added. This prior all-time high, previously hailed as a milestone, is now a possible support level that traders wish will stop further price declines. Featured image from Gemini Imagen, chart from TradingView